Quick Take

- U.S. CPI inflation matched forecasts by most measures, but we are nowhere near done yet.

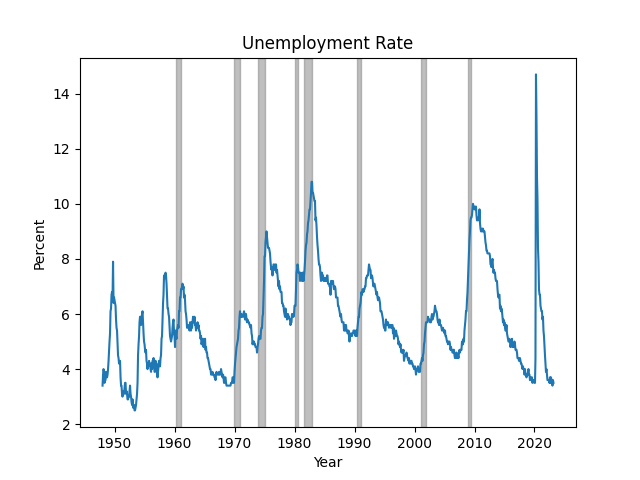

- Contrarian views have done well this cycle, a recession hasn’t occurred, and we are most likely facing the possibility of stagflation.

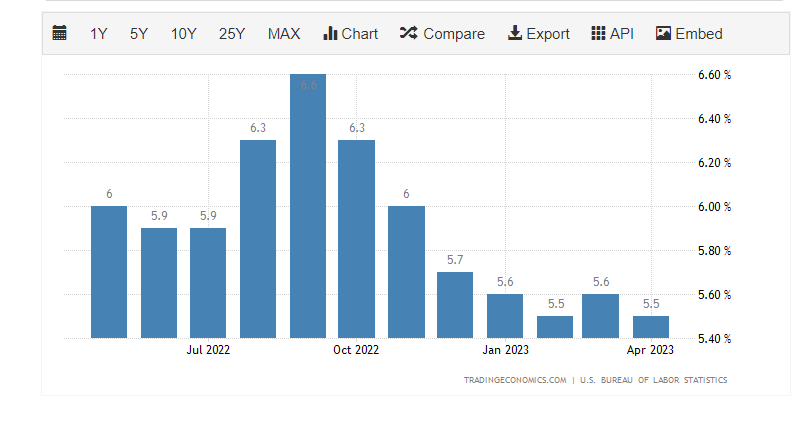

- The Fed has gone on the most aggressive tightening cycle in the past forty years, and core inflation is still around 5.5% — which has not budged for an entire year, slightly down from 6%.

- Core goods price inflation increased from 1.6% to 2.1%, while the monthly increase in core services CPI less shelter was up 0.3%.

- Unemployment is still at historic lows at 3.4% — which is not what the Fed wants to see. This will complicate their job in getting inflation to the 2% target.

- A similar pattern this decade may likely be the 70s, where we had high inflation and elevated interest rates.

Related Posts

The post This isn’t the inflation wave to be worried about – it’s the next one appeared first on CryptoSlate.