Quick Take

- The Grayscale Bitcoin Trust (GBTC) discount to NAV continues its contraction, currently standing at -33%. This represents the narrowest it has been for over a year, reflecting a potentially encouraging trend.

- GBTC has shown notable strength, rising 137% year-to-date. Notably, it has surged 50% since June 16th, a significant uptick coinciding with the initial filings for the BlackRock ETF.

- The BlackRock ETF filing has subsequently seen a wave of institutional filings, further stirring the market dynamics.

- Barry Silbert, the founder of Digital Currency Group (DCG), the parent company of Grayscale, finds himself in a comfortable position, consistently collecting his 2% management fees on the Bitcoin held within the fund.

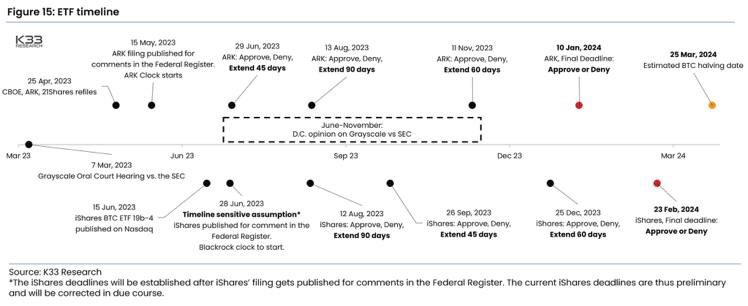

- According to K33 research, “D.C. opinion” on the ongoing lawsuit between Grayscale vs. SEC will likely come between June and November this year.

The post GBTC charges forward, 33% discount marks narrowest gap in over a year appeared first on CryptoSlate.