Quick Take

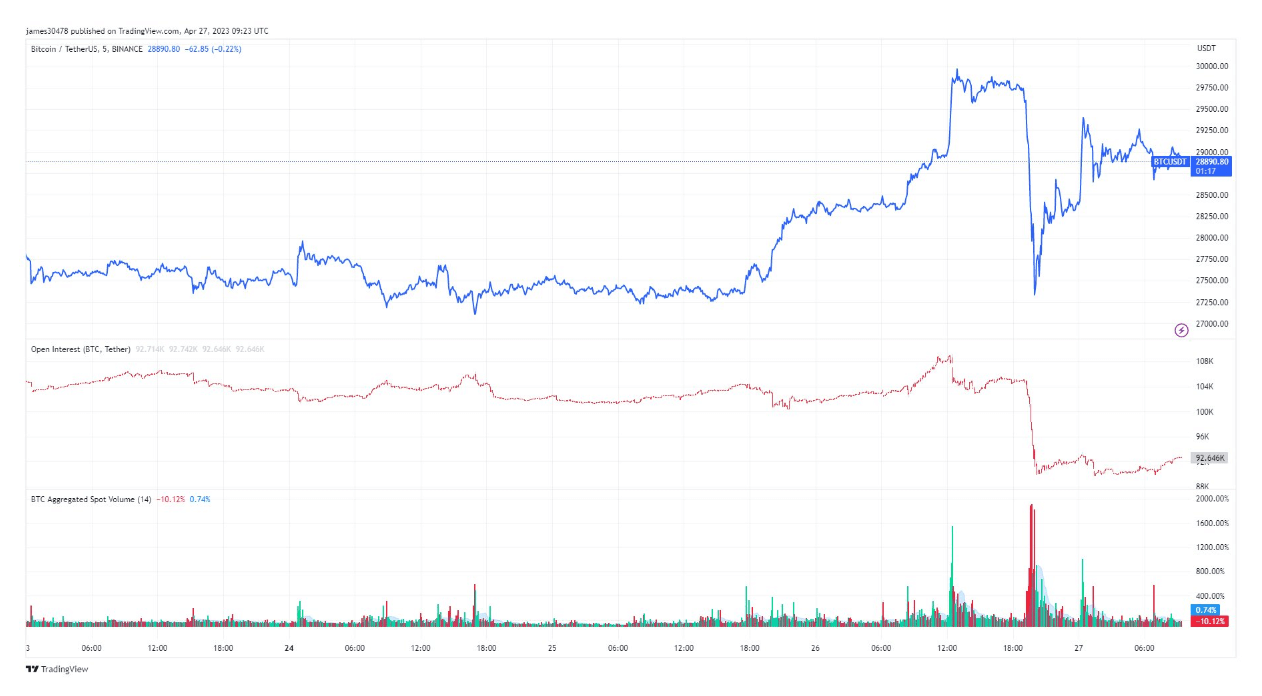

- Yesterday, Bitcoin saw price levels of over $29,000 and as low as $27,300, but CryptoSlate believes this is due to an illiquid market.

- Bitcoin liquidity has dropped considerably in 2022 and has only gotten more illiquid into 2023, meaning price action for Bitcoin can move in either direction quickly.

- Due to the illiquid market, futures open interest dictates the price action. The total funds allocated in open futures contracts is roughly 350k, heading towards year-to-date lows.

- We can see notable spot price action when Bitcoin reached $27,000.

- For the short-term, most definitely, we expect the volatility to continue in Bitcoin.

- As a result, in the past 24 hours, we have seen over $350 million in liquidations, both short and long-term.

Related Posts

The post Assessing Bitcoins price action over the last 12 hours appeared first on CryptoSlate.