Quick Take

- Bitcoin continues to hover around $28,000, with minimal price movement over the past week.

- Many macro updates have occurred this week, mainly bearish regarding the stalling U.S. economy and OPEC + announcement.

- Key reports coming out tomorrow include; U.S. unemployment data.

- However, Bitcoin options and futures take a fairly neutral stance with no heavy bearish or bullish bias.

- The future perpetual funding rate is slightly long but has flipped negative occasionally in the past week.

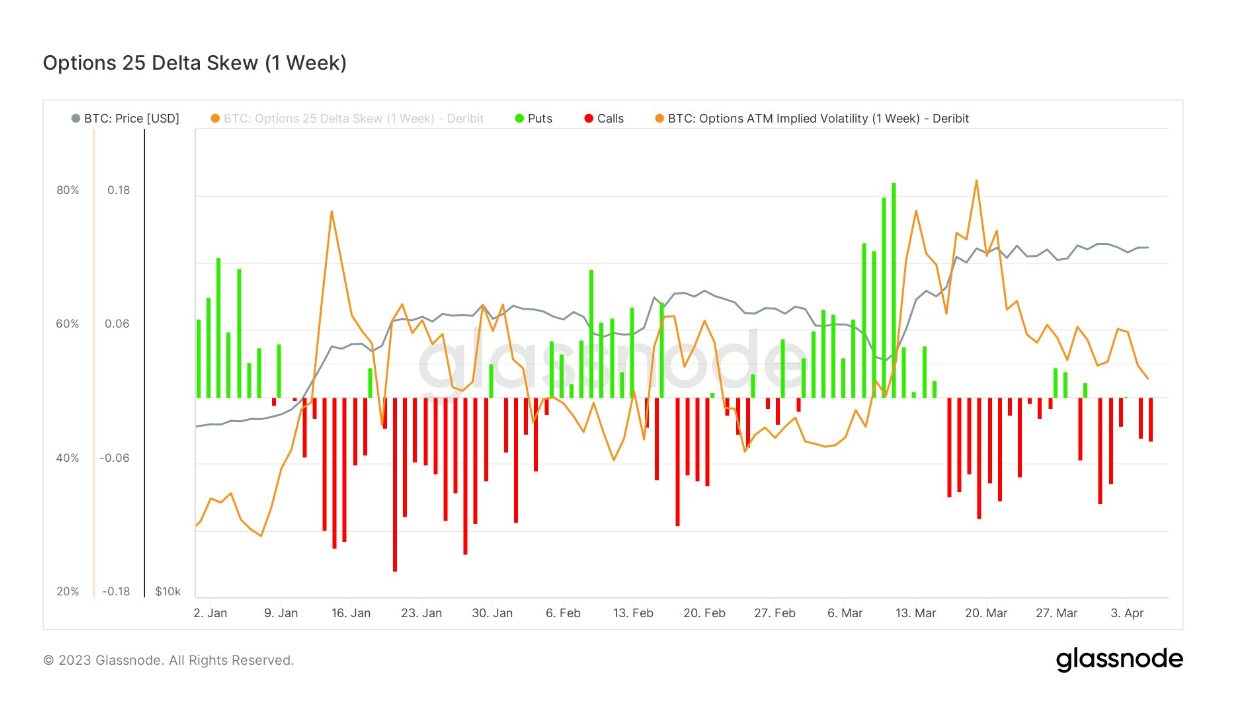

- While options implied volatility (IV) had continued lower from the SVB collapse at the end of March. At the same time, we see an even amount of buyers for both puts and calls across the curve.

- This also coincides with a decreased market depth liquidity for Bitcoin and Ethereum.

Related Posts

The post Bitcoin futures, options markets remain fairly neutral before US jobs report appeared first on CryptoSlate.