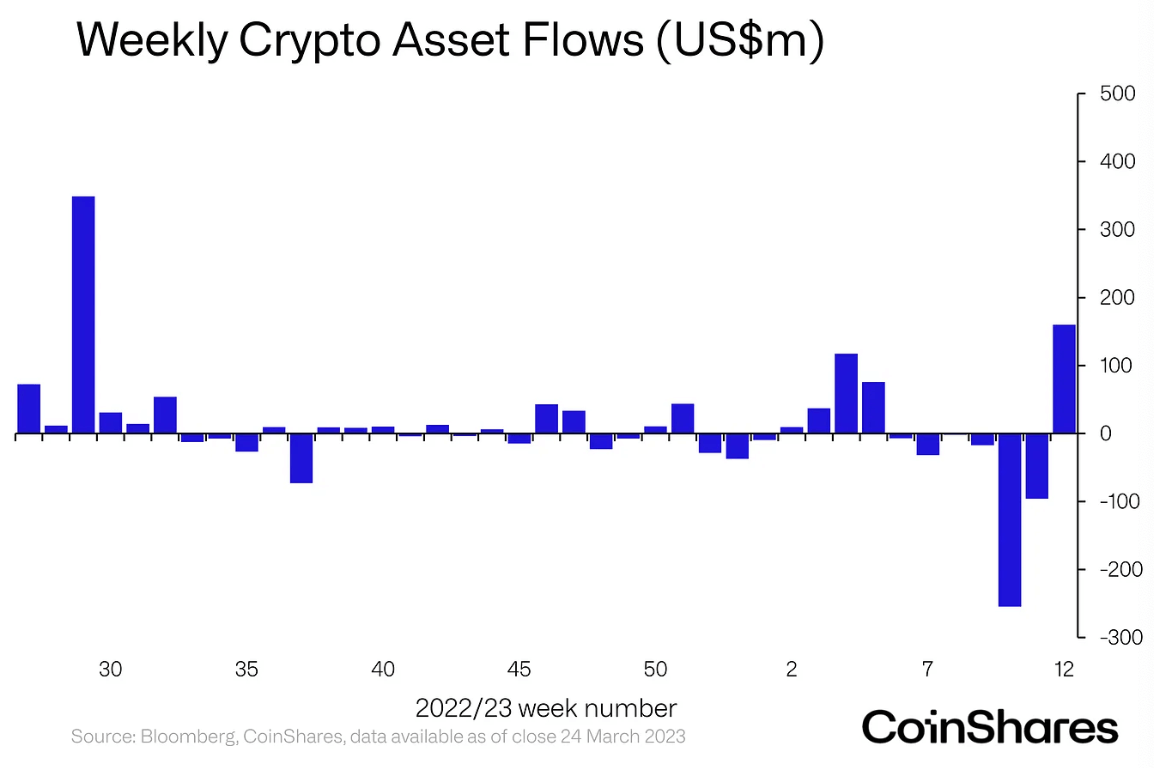

Digital asset investment products broke its six-consecutive-week of outflows strike and recorded $160 million in inflows during the week of March 20, according to CoinShares report.

Last week’s inflows mark the most significant positive movement since July 2022, as the CoinShares data indicates. Crypto-based investment products have been recording outflows since the beginning of February — with aggregate value reaching $408 million.

The report acknowledges that the inflows were seen relatively late compared to the broader crypto market. It notes that it might be due to “increasing fears amongst investors for stability in the traditional finance sector.”

The largest outflow was recorded during the week of March 6 at a total of $255 million in outflows. At the time, this amount represented 1% of the market and wiped out inflows recorded for the whole year.

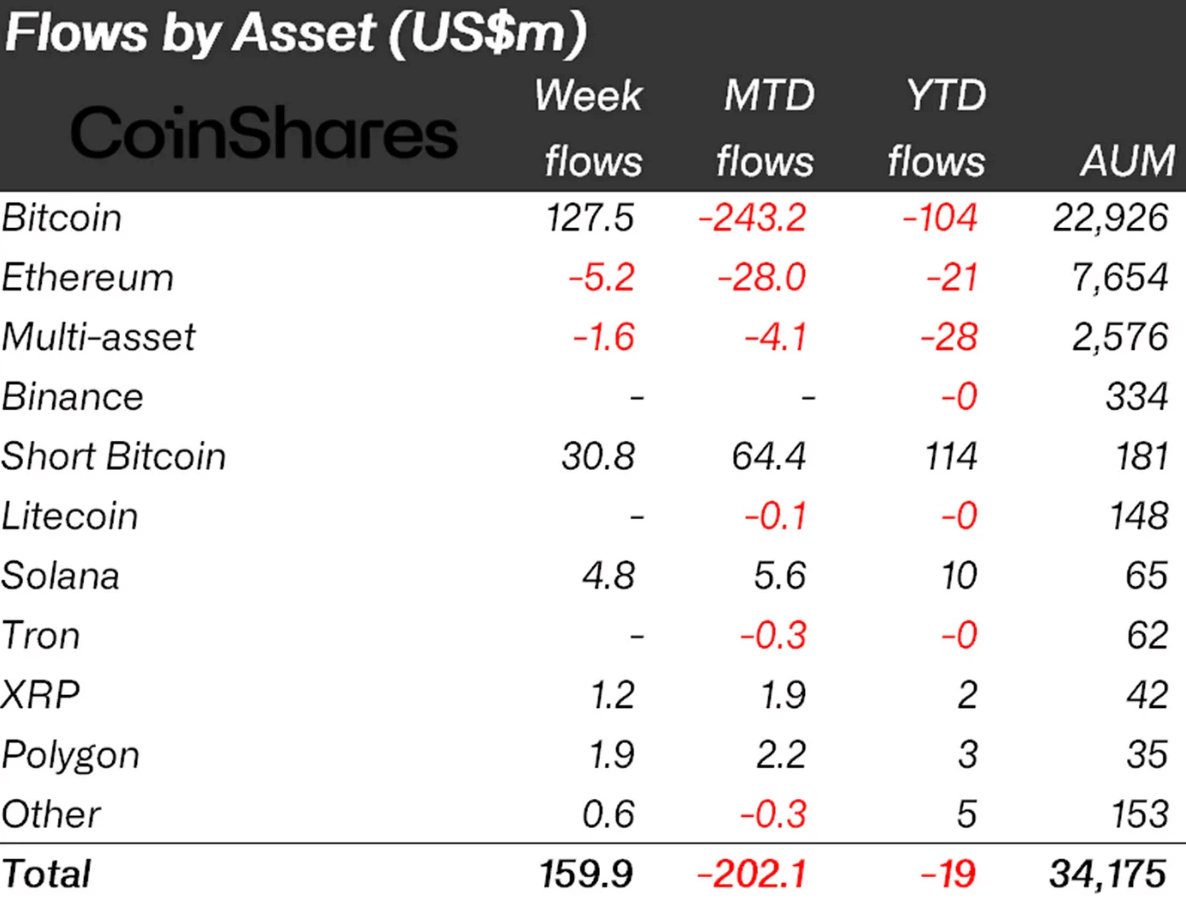

Flows by asset

Bitcoin (BTC) based investment products recorded the most considerable inflows with $127.5 million — accounting for almost 80% of the total amount.

Short-BTC and Solana (SOL) based investment products collected the second and third most significant inflows with $30.8 million and $4.8 million, respectively. Short-BTC has been recording inflows even during the six-week-outflow strike — indicating that the investment product collected the most inflows since the beginning of the year.

Ripple (XRP) and Polygon (MATIC) also recorded inflows worth $1.2 million and $1.9 million, respectively.

Meanwhile, Ethereum (ETH) based investment products saw $5.2 million in outflows. This marked the third consecutive week of outflows for ETH-based products. The report states that ETH’s Shanghai upgrade is expected to occur on April 12 — which could cause “investors’ jitters.”

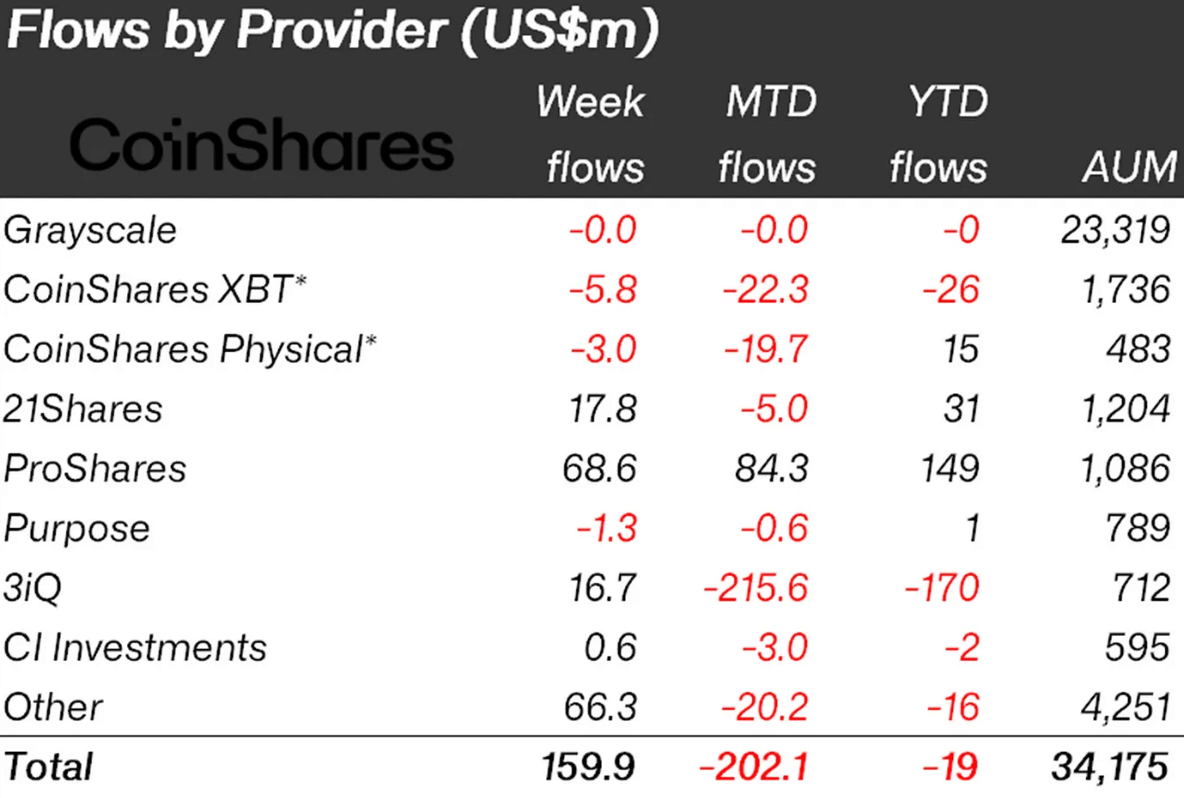

Flows by provider

Regarding the flow of funds based on the providers, ProShares comes forward as it saw $68.6 million in inflows — accounting for 42% of the total amount.

21Shares and 3iQ closely follow as the second and the third by recording $17.8 million and $16.7 million in inflows, respectively.

Meanwhile CoinShares Physical and CoinShares XBT lost an aggregate of $8.8 million — while Purpose saw another $1.3 million in outflows.

The US invests the most

The report also noted that the U.S recorded an immense amount of inflows — contributing $69.1 million on its own which accounted for 43% of the total $160 million.

Germany, Canada, and Switzerland followed the U.S. — recording the second, third, and fourth most significant inflows with $57.8 million, $26.1 million, and $16.6 million, respectively.

Meanwhile, Sweden, Brazil, and France recorded outflows worth $5.8 million, $3.9 million, and $100,000, respectively.