Quick Take

- The options market is finally starting to price in the Ethereum Shanghai upgrade, supposedly scheduled for April 12.

- Options 25 delta skew at the front end (1 week to 1 Month) suggests bearish sentiment, with puts starting to dominate calls.

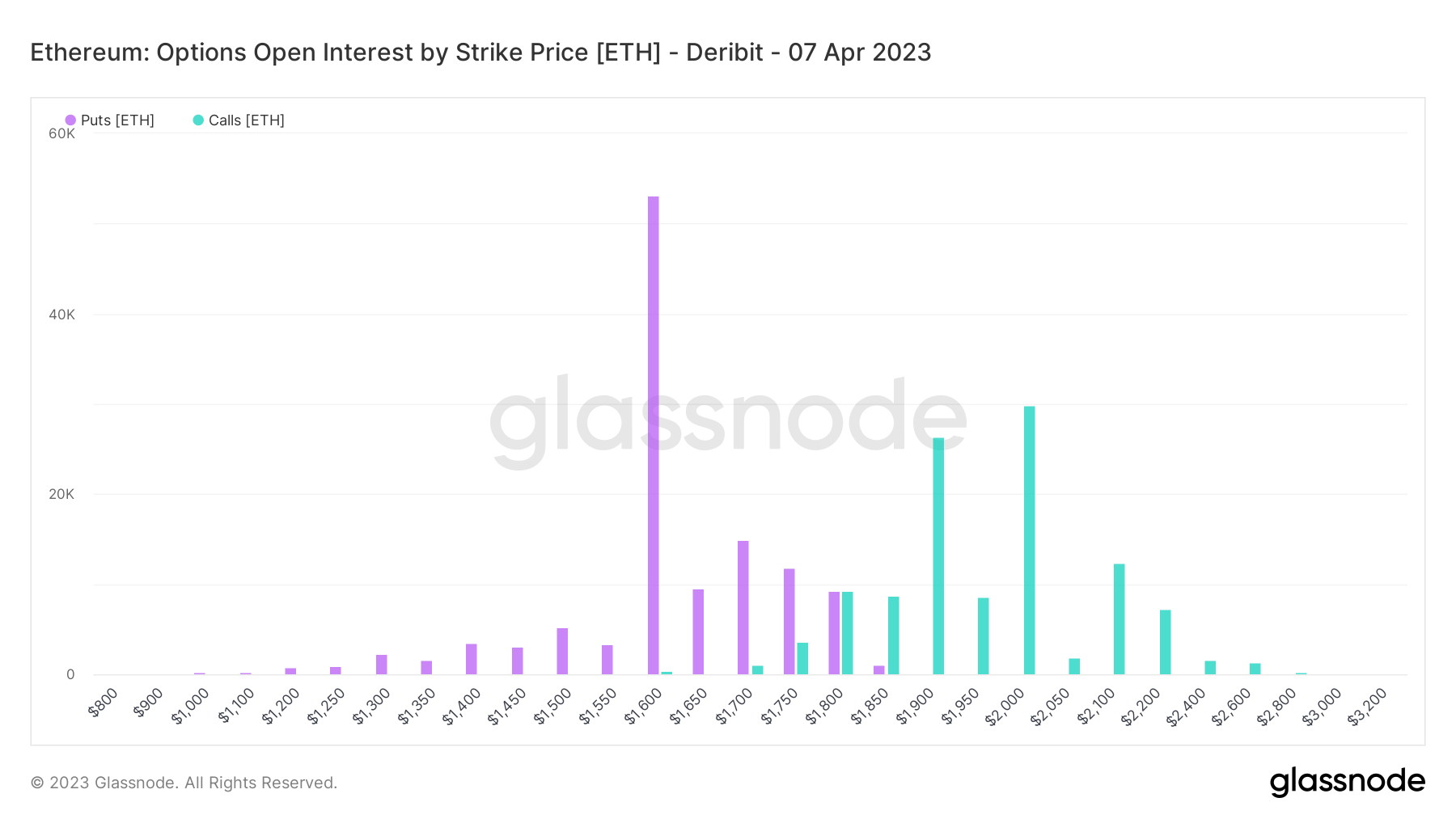

- Furthermore, looking at options open interest by strike price — an overwhelming amount of puts (50,000 ETH) calling for $1,600 for April 7.

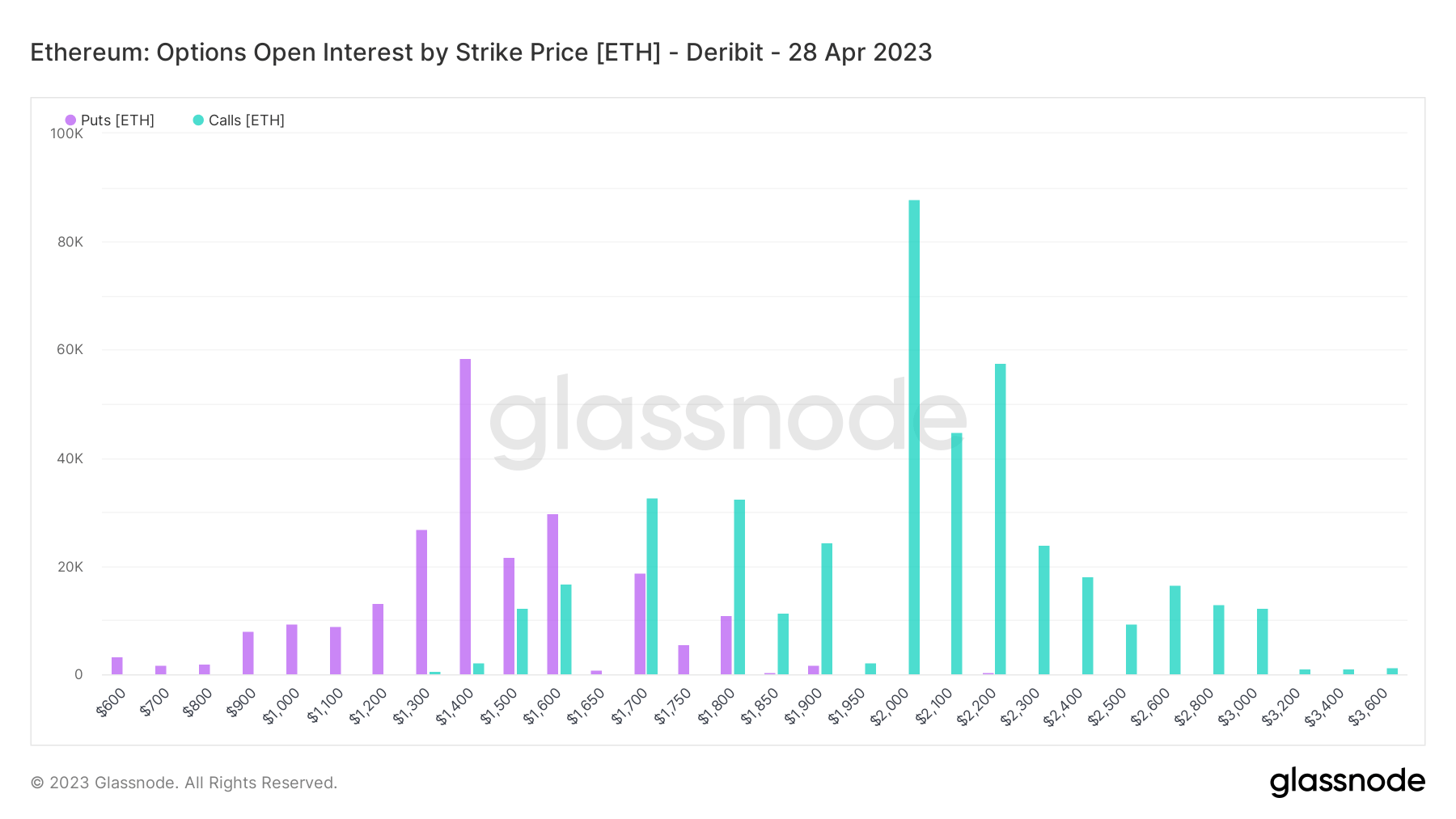

- However, on April 28, the options market is slightly bullish — with 90,000 ETH calls at $2,000.

- Negative sentiment towards Ethereum in the short term due to the potential of “unlocks.”

Related Posts

The post Investors wary as Shanghai upgrade looms, options market signals negative sentiment appeared first on CryptoSlate.