Bitcoin had the most volatile weekend in a year as Bitcoin slipped as low as $64,550 after reaching a new all-time high of $72.760 on Thursday, March 14. As of press time, Bitcoin has recovered to trade around $68,300. However, several price swings between 3% – 7% have been prevalent throughout the weekend.

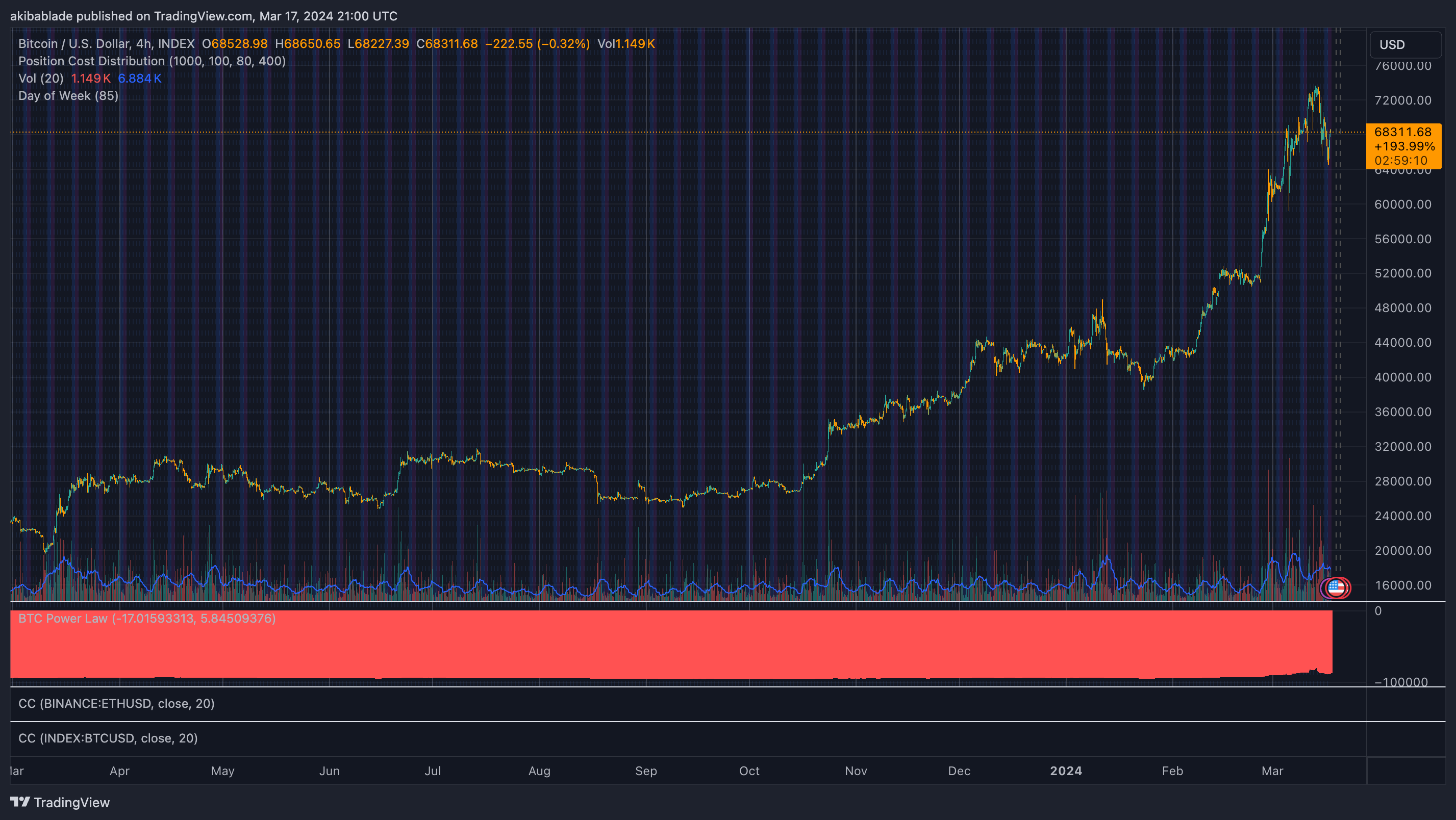

Bitcoin has seen fairly stable weekend trading since the launch of the Bitcoin ETFs in the US earlier this year, with most of the volatility occurring early in the week during US trading hours. However, further analysis of weekend periods throughout 2023 reveals that flat weekends were a trend for much of 2023.

The vertical bars on the charts above denote Saturdays and Sundays trading for Bitcoin throughout 2023 and 2024. Unlike this weekend, most weekends saw little price swings beyond 2-3%. Bitcoin’s fear and greed index remains in the ‘extreme greed‘ zone, while it has fallen a couple of points since last week’s heights.

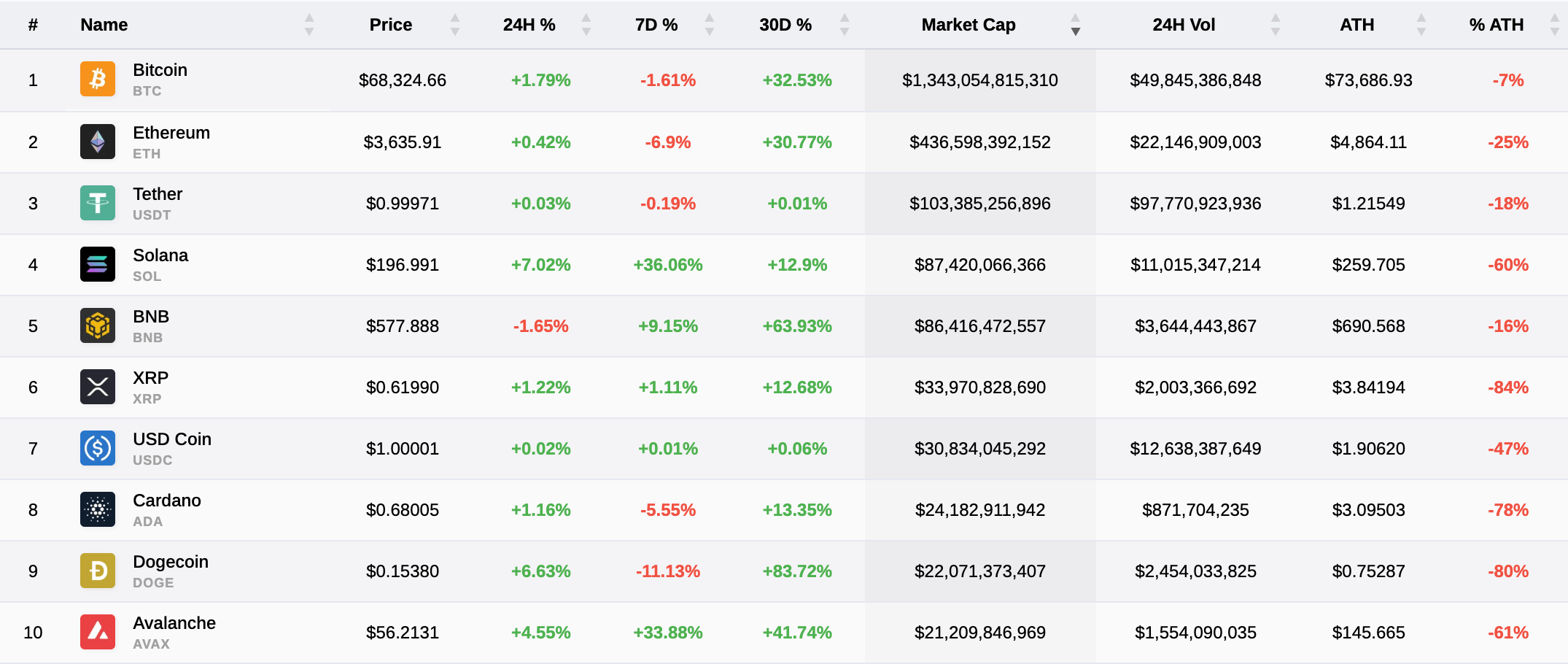

Across the broader market, a sea of green denotes positive movement over the past 24 hours, with the majority remaining positive over the last seven days. The most notable is Solana, which has seen a dramatic 36% increase over the past week, rising against Bitcoin and leading the market.

Dogecoin, Cardano, and Ethereum are the only digital assets that have not recovered to near local highs over the past seven days. However, only Bitcoin and BNB Chain are currently within 20% of the all-time highs.

As of press time, the US market would gap down roughly 2% if the price remained at current levels over the next 16 hours.

The post Most volatile weekend in a year as Solana dominates yet Bitcoin recovers appeared first on CryptoSlate.