Quick Take

- The fed funds rate now implies that rate cuts are off the table for 2023 and are expected to remain higher for a longer time frame in the year.

- As the year progresses, rate hikes are expected to continue, while rates are expected to hold steady in the second half of 2023.

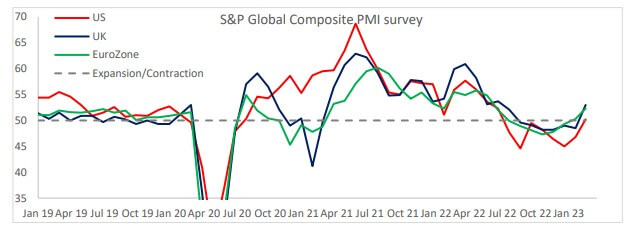

- A solid improvement in yesterday’s U.S. PMIs reinforced the need for further policy tightening, particularly with inflation slowing less than expected in the U.S.

- The S&P composite PMI jumped out of contraction on an absolute basis, showing significant improvement.

Related Posts

The post Rate cuts potentially off the table for 2023 appeared first on CryptoSlate.