Quick Take

- Between the months of November 2022 and January, Bitcoin fell below $20k.

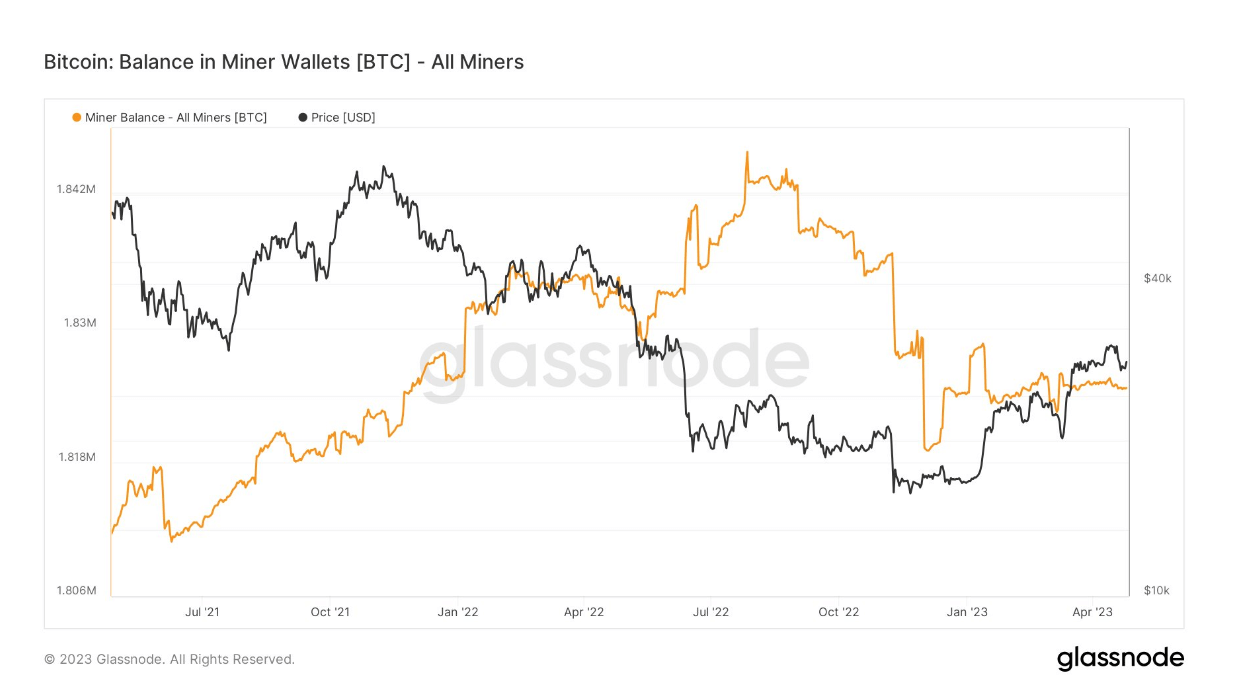

- According to the Difficulty regression model (The all-in cost to mine 1 Bitcoin), it was an unprofitable time for miners.

- Miners were distributing coins in excess of the mined supply, with Values > 100%, and depleting treasury reserves.

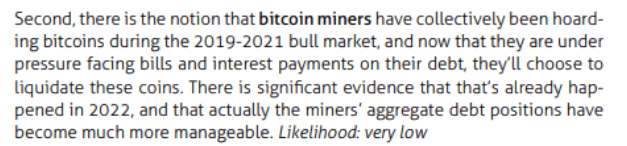

- Now, the miner supply spent indicates value = 100%; in the aggregate, a volume of coins equal to the total mined supply was spent. This is supported by the miner balance which is flat year-to-date.

- In Tuur Demeester’s latest report, CryptoSlate agrees that miner capitulation was last year, and miners are much stronger from a debt position point of view (See extract below).

Related Posts

The post Why the Bitcoin miner capitulation was in 2022 appeared first on CryptoSlate.