The total value of assets locked (TVL) in Cardano’s decentralized finance (DeFi) ecosystem is approaching a 21-month high of $300 million on the back of the blockchain network’s native ADA token bullish price movement.

Per DeFillama data, Cardano’s TVL sits at $298 million as of press time, representing a 508% growth on the year-to-date (YTD) metric for a network whose TVL stood at under $50 million at the start of the year.

TVL measures the value of digital assets locked in a particular DeFi protocol/ecosystem. It can be used to gauge an ecosystem’s health and perceived trust, as a rising TVL suggests investors’ willingness to use the protocol/ecosystem.

Cardano DeFi activities

Data from DeFillama shows that DeFi activity on Cardano is witnessing a resurgence amid the bullish market sentiment.

Per the data aggregator’s dashboard, decentralized exchanges’ trading volume on Cardano during the last 24 hours stood at more than $10 million, while this same metric has recorded a 103% weekly increase to $41.31 million as of press time.

This represents a significant turnaround for a network whose DEXs processed less than $50 million in transactions in September. If the current trend persists, the blockchain will breach the $100 million monthly trading volume mark for the first time since August.

Other critical metrics for the network also point to an improving network activity. For context, the blockchain’s returning addresses have consistently averaged more than 40,000 in December, an increase from the average of 30,000 recorded throughout November.

Amid these developments, DeFi protocols on the network, like Lenfi, have seen their TVL rise to new all-time highs.

ADA price increases

Cardano’s ADA token has also emerged among the top-performing cryptocurrencies amid the general optimism pervading the digital assets market.

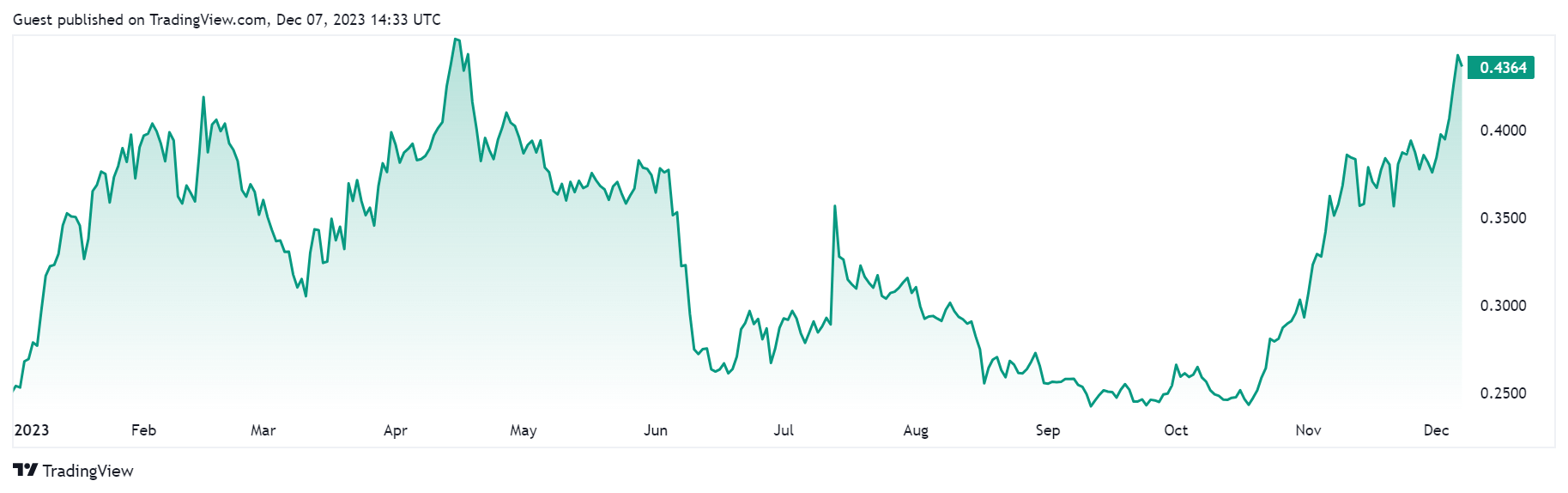

Data from CryptoSlate shows that ADA’s price increased by more than 15% during the past week, moving to as high as $0.45 from $0.37 during the last seven days. However, its value has retraced to $0.43 as of press time.

The price movement added around $2 billion to its market capitalization, which stood at $15.38 billion as of press time.

CryptoSlate’s data further shows a 77% growth on the YTD metric.