Global digital asset investment products saw significant inflows last week, totaling $1.1 billion, propelling the year-to-date figure to $2.7 billion.

The latest weekly report from CoinShares confirmed the surge in the inflow of funds into digital asset investment products, which pushed the assets under management to a peak not seen since early 2022, now standing at $59 billion. The US spot ETF market played a pivotal role in this development, capturing $1.1 billion of last week’s inflows.

Bitcoin remains the clear market leader, garnering approximately 98% of total inflows last week. Increased confidence also permeated through to Ethereum and Cardano, receiving inflows of $16 million and $6 million, respectively. Altcoins such as Avalanche, Polygon, and Tron saw minor yet sustained inflows throughout the period. Blockchain equities exhibited mixed results as a single issuer predominantly drove outflows; others in the sector observed incremental gains.

The report also sheds light on the regional trends of these inflows. While the US leads, other regions have shown mixed reactions. Switzerland, for instance, reported $35 million in inflows, contrasting with minor outflows from Canada and Germany. This geographical distribution of inflows and outflows highlights the nuanced global perspective on digital asset investments.

CoinShares’ analysis indicates a slowdown in outflows from incumbent digital asset funds, although concerns linger over the potential impact of Genesis’ $1.6 billion holdings sale.

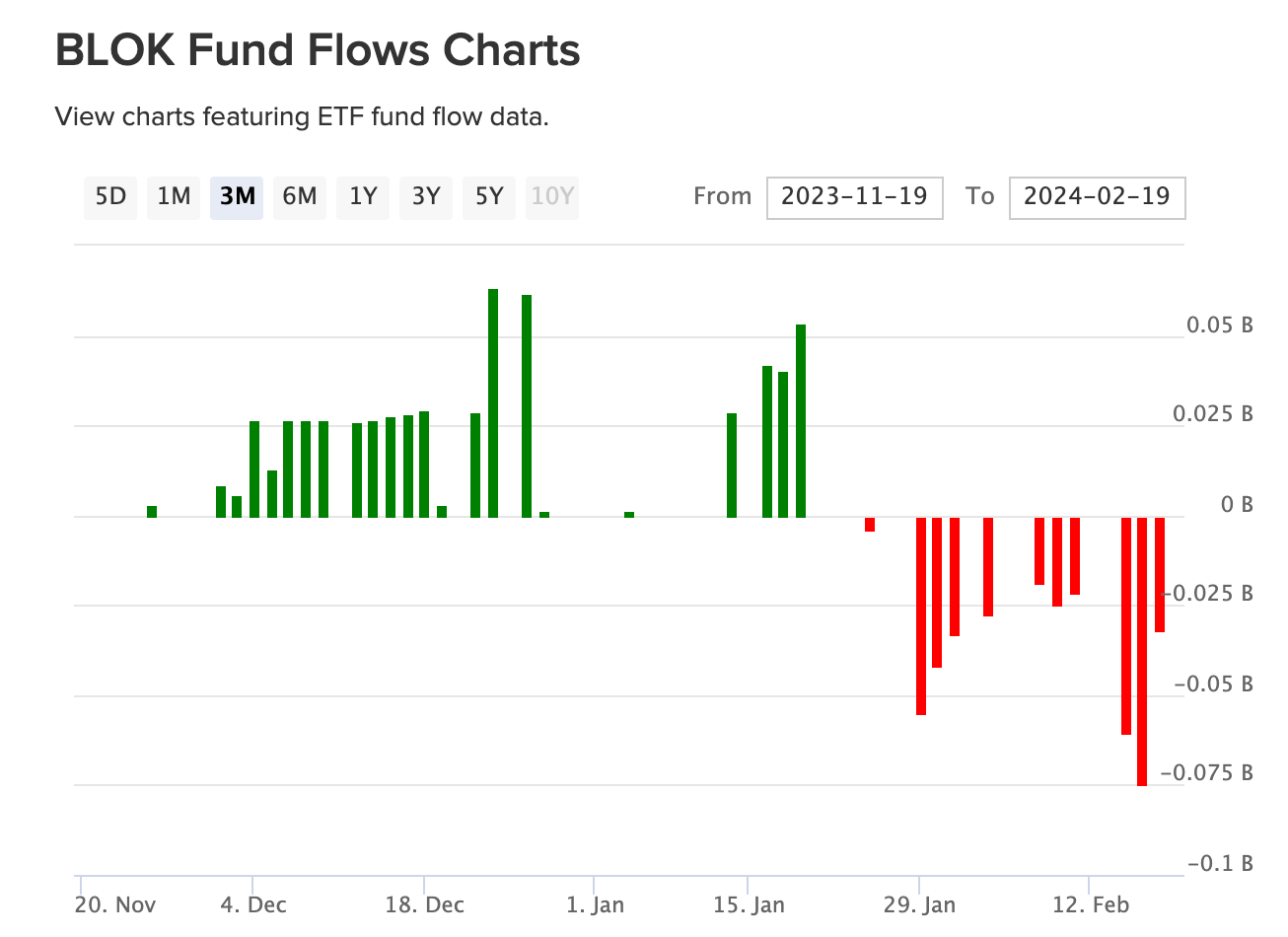

The overall trend in digital asset investment products is positive. Blockchain equities, however, experienced a mixed bag, with a notable outflow from Amplify Transformational Data Sharing ETF (BLOK) totaling $67 million, while others saw collective inflows of $19 million. This contrast illustrates the varied investor sentiment and strategies at play within the broader crypto and blockchain investment landscape. According to the VettaFi ETF Database, BLOK has seen persistent outflows since mid-January.

In summary, the latest CoinShares report emphasizes a robust influx of capital into digital asset investment products, with a continued concentration on Bitcoin. The significant inflows, the highest AuM since early 2022, and the regional variations in investment flow reflect the growing maturity and complexity of the crypto investment space.