The NFT craze of 2021 swept across almost every industry and made non-fungible tokens a household name across the globe, making NFTs, which were once reserved only for a small niche of crypto enthusiasts, catch the eyes of legacy brands that joined in on the craze.

After buying sought-after NFT collections like the BAYC or Cryptopunks, many legacy brands dove deeper into the ecosystem by issuing their own non-fungibles. At the time, companies minting their own NFTs was certainly newsworthy, with brands like Nike, Adidas, Dolce&Gabbana, and Tiffany frequently appearing in crypto headlines.

As weeks went by, the viscous crypto news cycle drowned out stories about the NFTs issued by those brands, and they disappeared from the radar of the industry. Many began to wonder how these NFT collections weathered the bear market and how the brands benefited from their sales.

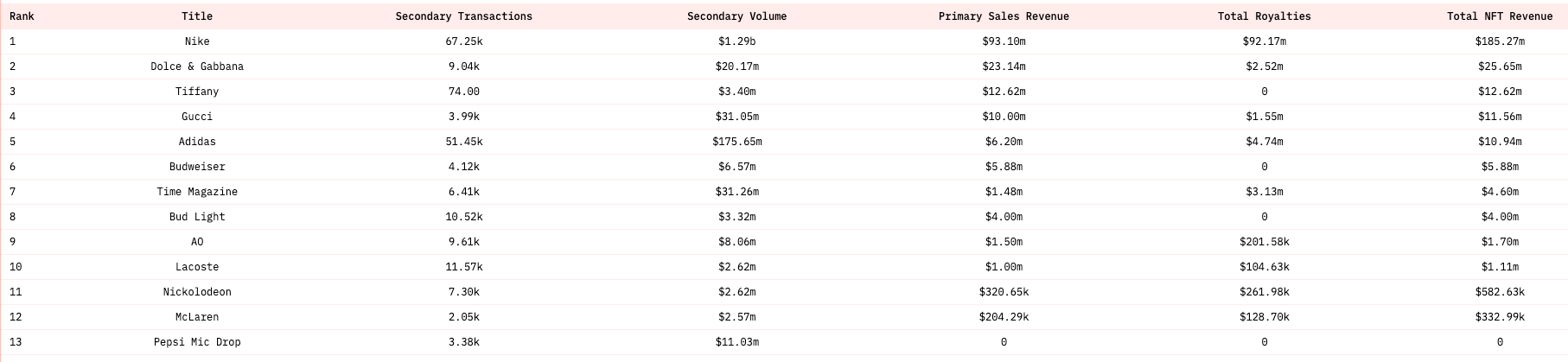

According to data from Dune Analytics, out of all the brands that issued NFT collections on Ethereum, Nike ranked the highest with total revenue of $185.27 million. Nike pocketed $93.10 million from the primary sale of its NFTs and another $92.17 million from royalties.

The Cryptokicks collection saw over 67,250 transactions on the secondary market and recorded $1.29 billion in secondary volume, almost tenfold what its competitor Adidas recorded.

With $25.65 million in total revenue, high fashion giant Dolce & Gabbana ranked second. Out of the $25.65 million, only $2.52 million came from royalties, as its Genesis virtual collection only saw around 9,000 secondary transactions.

Tiffany saw the third-largest revenue from its NFT collection, pocketing $12.62 million. However, its 250 “NFTiffs” collection returned no royalties as their owners all redeemed the tokens for custom Cryptopunks pendants.

Following in the footsteps of Dolce & Gabbana is Gucci, which saw $11.56 million in revenue from NFTs. Its NFT collection recorded over $31 million in secondary volume.

And while Nike’s main competitor Adidas saw only $10.94 million in revenue, its NFT collection did significantly better on the secondary market. The “Adidas Originals Into the Metaverse” collection grants owners exclusive rights to Adidas merch throughout the year and saw over 51,000 transactions on the secondary market, generating $175.65 million in volume.

Budweiser, Time Magazine, and Bud Light saw $5.88 million, $4.60 million, and $4 million in total revenue from their NFT collections. Neither Budweiser nor Bud Light made any profits from royalties. Australian Open and Lacoste pocketed $1.70 million and $1.11 million from their collections.