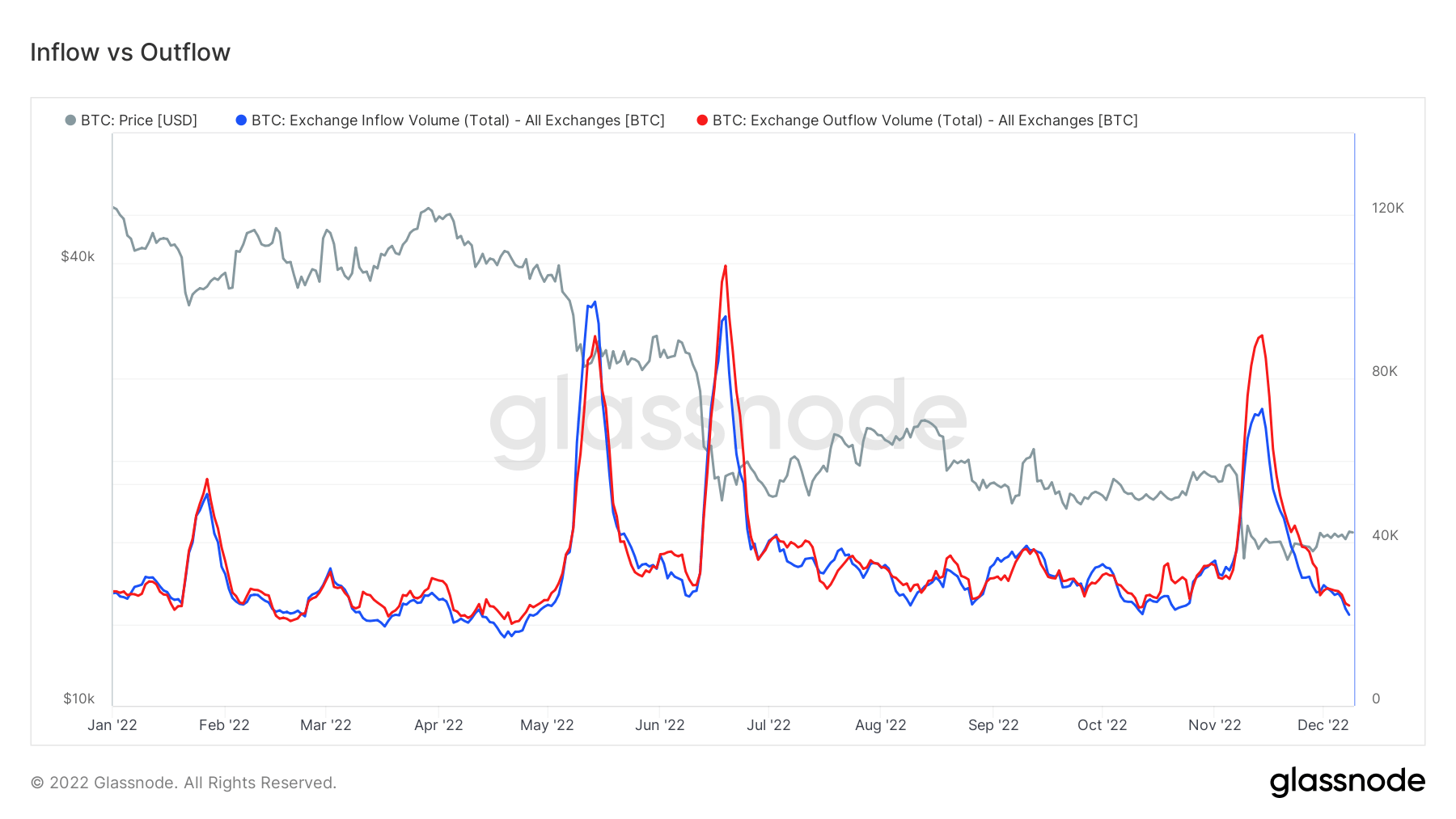

On-chain data from Glassnode, analyzed by CryptoSlate, shows in the event of bad news, Bitcoiners act with bullish conviction 75% of the time. Furthermore, the analysis of the exchange inflow/outflow chart from Glassnode revealed that even during bearish events, Bitcoiners retain confidence regarding exchange trading.

Inflows and outflows usually mirror one another. The chart below shows similarities between the patterns of the two. The most significant divergence between exchange inflow and outflows in 2022 occurred during the collapse of FTX in November, as trust in exchanges fell rather than conviction in Bitcoin.

Bitcoin Inflow vs. Outflow

Bitcoin exchange inflow and outflow describe tokens entering and leaving exchanges within a given period.

Fluctuations in inflows and outflows are used to gauge market sentiment. The former equates to bad news/low sentiment increasing selling pressure. While the latter is generally taken as a bullish sign, in that withdrawals are mainly done for storage in the belief price will go higher in the long term.

However, throughout 2022, notable variations between the two came from:

- February: War in Eastern Europe saw outflows reach 55,000, while inflows were 51,000.

- May: Fed implemented a second rate rise in 2022, confirming to markets the period of cheap money is over. This saw inflows hit 97,000, significantly greater than outflows of 85,000.

- June: Outflows totaled 108,000 vs. 95,000 inflows. This can be explained as Bitcoin believers battening down in the face of the Terra implosion.

- November: Outflows of 91,000 vs. 73,000 inflows. Similar to June, but this time in respect of the FTX collapse.

Three of the four most significant market-moving events this year, which would typically trigger flight, had the opposite effect, as demonstrated by outflows exceeding inflows.

This would suggest that, for a significant segment of BTC investors, bad news does not shake their belief in the token.