The price of Bitcoin sank following the release of Consumer Price Index (CPI) data by the U.S. Bureau of Labor Statistics (BLS), showing a 0.1% increase in August, taking the unadjusted value to 8.3%.

In response to last month’s BLS CPI report, released on August 10, Bitcoin closed the day up 5% to $24,050. BTC has since been trending lower to form a local bottom at $18,700 on September 7.

Since then, BTC has printed six consecutive daily green closes, with today’s price also trending higher ahead of the BLS announcement.

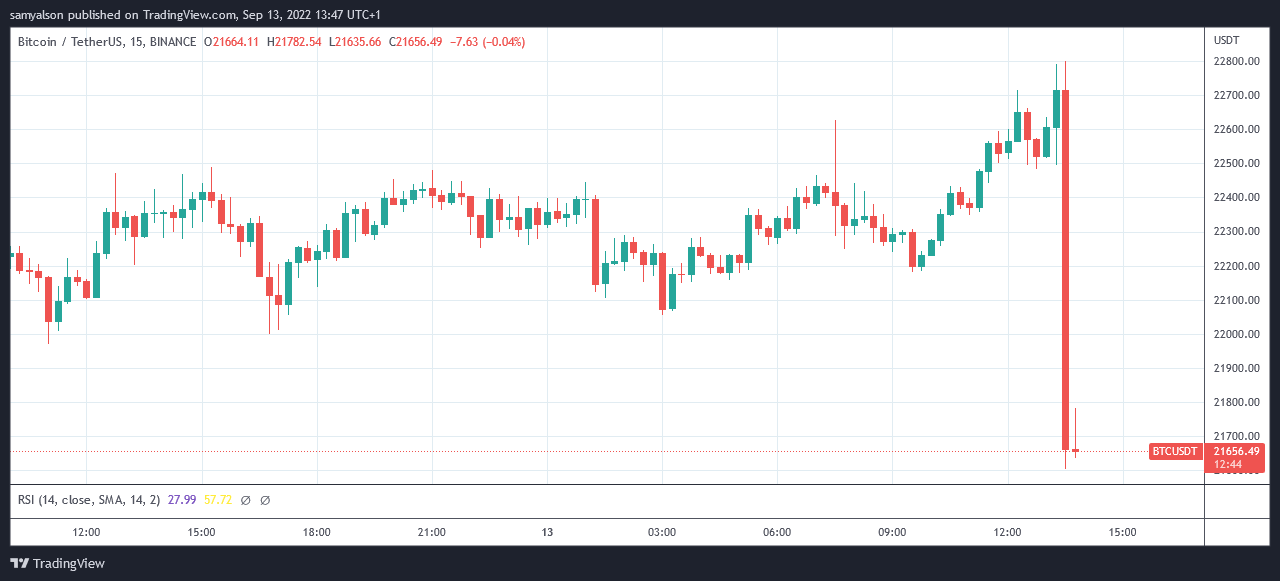

However, on the release of CPI data at 13:30 UTC, BTC’s immediate reaction was a 5% downside swing to bounce at $21,600.

Attention turns to the September FOMC meeting

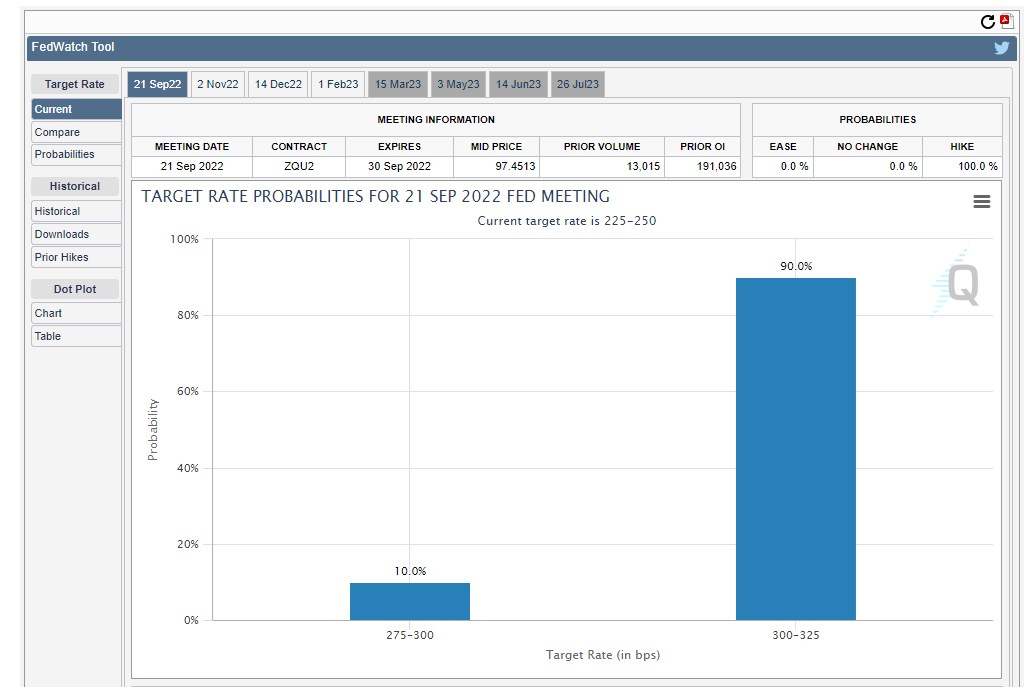

Following the previous Federal Open Market Committee (FOMC) on July 27, the Fed enacted a 75 basis point interest rate hike in a bid to address mounting inflationary pressures.

The next FOMC meeting is scheduled to occur between September 20-21, with 90% of experts now targeting a 75 basis point hike. If implemented, it would make a third consecutive 75 basis point hike.

With no sign of the Fed slowing down its hawkish position, the outlook for risk-on assets remains near term bearish.