Bitcoin prices rose above $44,200 on Feb. 7, a price level observed shortly after spot Bitcoin ETFs gained approval last month.

Specifically, Bitcoin (BTC) is up 2.5% over 24 hours as of 10:45 p.m. UTC, with a market price of $44,263.78 and a capitalization of $868 billion.

This marks a nearly one-month high, as BTC was previously priced at $44,200 on Jan. 12, days after the approval of spot Bitcoin ETFs. Nevertheless, the current price is still far from Bitcoin’s one-month high of $48,494 on Jan. 11.

Meanwhile, Coinglass data indicates that the crypto market has seen $102.94 million in liquidations over 24 hours. That total is largely made up of $31.57 million of BTC liquidations and $18.34 million of ETH liquidations.

The crypto market is up 2.3% on average over 24 hours. Top altcoins have seen comparable gains: Solana (SOL) is up 3.4%, Avalanche (AVAX) is up 3.0%, Ethereum (ETH) is up 1.9%, BNB is up 1.7%, and Dogecoin (DOGE) is up 1.7%.

Various factors may be at play

The reasons for the latest price gains are not entirely known. January highs were likely due to anticipation around spot Bitcoin ETFs that faded after approval.

Recent gains may partly be due to anticipation of spot Ethereum ETFs and spot Bitcoin ETF options. Today’s market-wide 2.3% gains are relatively modest, in line with a lack of certainty around approving those products.

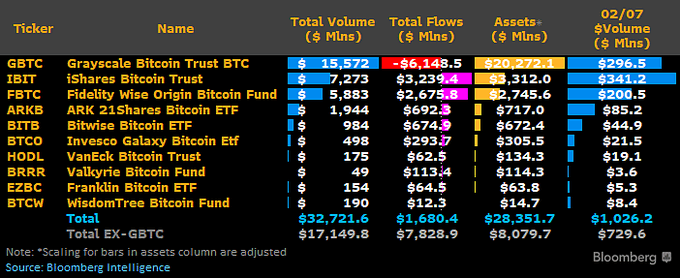

Continued inflows into spot Bitcoin ETFs may also affect Bitcoin prices. Bloomberg ETF analyst James Seyffart’s latest data indicates that spot Bitcoin ETFs have seen $1.68 billion in inflows after considering Grayscale’s GBTC outflows. Bitcoin locked in ETF trusts can increase prices by creating greater demand for the remaining supply among investors.

The post Bitcoin surpasses $44.2k, a level last seen days after Bitcoin ETF approvals appeared first on CryptoSlate.