Market jitters from the FTX collapse have triggered record quantities of Bitcoin leaving global exchanges.

Bitcoin Magazine Senior Analyst Dylan LeClair noted that 136,992 BTC had been withdrawn over the past 30 days, adding that the event was “historic.” The figure equates to 0.7% of the circulating supply.

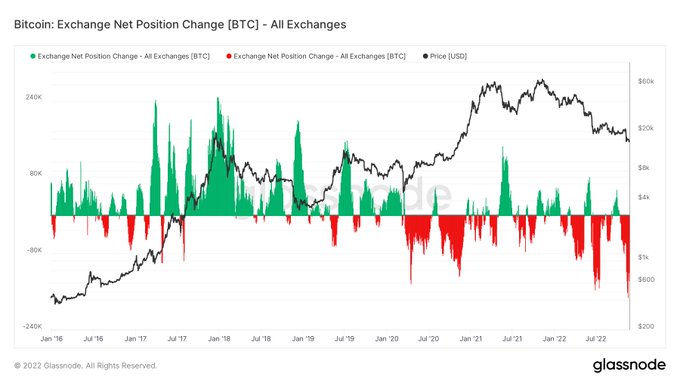

Accompanying the message, LeClair included an Exchange Net Position chart illustrating the scale of the exodus. The chart below shows net outflows from global exchanges at their highest since 2016.

The previous outflow peak was around June, at the height of the Terra implosion, which saw approximately 120,000 tokens leaving exchanges.

In reference to the outflow trend, LeClair further commented, “Drain. Them. All.”

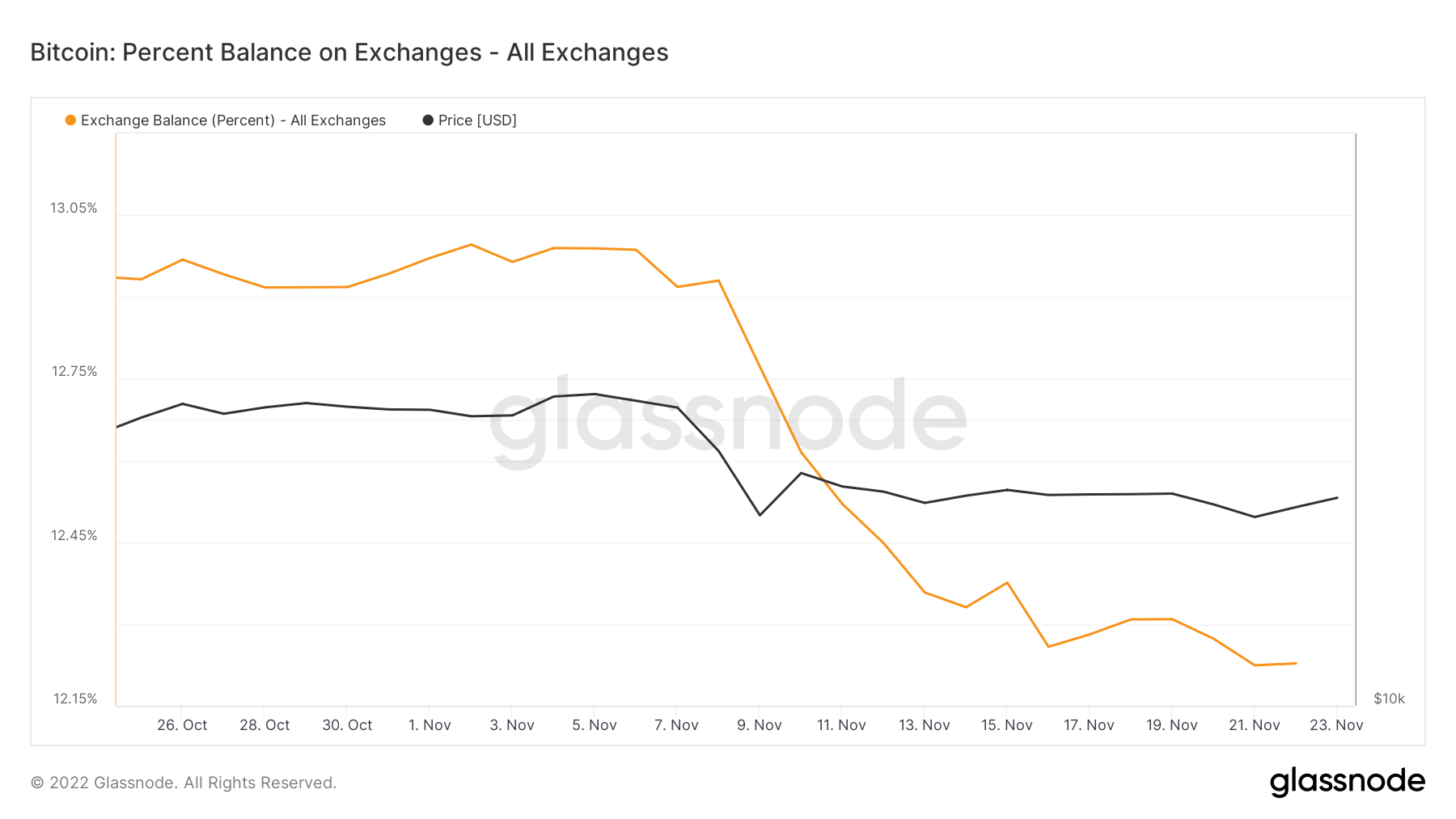

Data per Glassnode shows holders heeding the warnings as the percentage of Bitcoin held on exchanges drops from 13% to 12.2% since rumors of trouble at FTX first broke.

Can Bitcoin build on recent gains?

As news of FTX mismanagement filtered into the public domain, the price of Bitcoin saw sharp sell-offs in response to the allegations.

The peak-to-trough movement saw a 28% drawdown for the leading cryptocurrency, with a local bottom of $15,500 hit on Nov. 21.

Since bottoming, signs of price recovery have presented, with Tuesday closing 3.8% up on the day. At the same time, today saw a continuation of buying pressure as BTC grew 5% over the last 24 hours at the time of press.

However, macro conditions remain the same, meaning the likelihood of bulls building on current price action, to make a meaningful strike back above $20,000 and beyond, is slim.

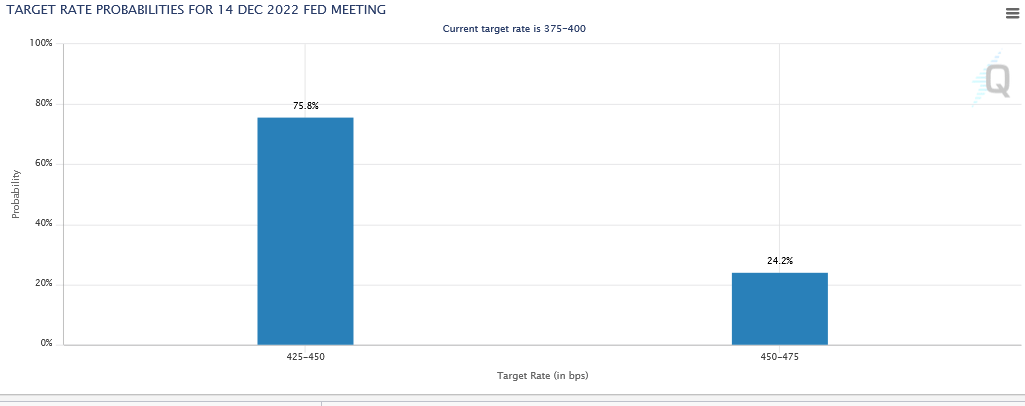

Investors are currently poised for a reversal in the Fed’s rate hike policy, before deploying capital. Fed Chair Jerome Powell enacted a fourth consecutive 75 basis point hike on Nov.2, bringing the Federal Funds Rate to 3.75 – 4%.

Markets are currently three to four in favor of a 50 basis point hike next, thus optimistic over the Fed easing its pace of rate increases.

The FOMC will announce the outcome of their next meeting on Dec. 14.

Contagion risk

Amid the FTX contagion, crypto brokerage Genesis warned that it needs$1 billion in capital to stave off bankruptcy. The firm is considered a significant Bitcoin OTC desk.

To date, having approached Binance and Apollo for assistance, the struggling brokerage has yet to raise the money it said it needed to stay solvent.

A full rundown of what went wrong is unknown at this time. However, Leigh Drogen, the CIO of investment management firm Starkiller Capital, claimed the source of Genesis’s problems stemmed from a loan agreement with parent company Digital Capital Group (DCG).

What im basically hearing from Genesis clients is that Barry did something similar to Sam, he made a related party loan between genesis and DCG and he’s in a huge hole now

— Leigh Drogen (@LDrogen) November 21, 2022

Nonetheless, DCG CEO Barry Silbert recently played down the extent of the liquidity crisis, saying Genesis is due $575 million from DCG in May 2023 and group revenue of $800 million is expected this year.