Bitcoin’s fall from its all-time high to a low of $15,700 has been one of the most dominating narratives this year. Bitcoin lost 75% of its value since Nov. 10, 2020, and over 65% since the beginning of the year.

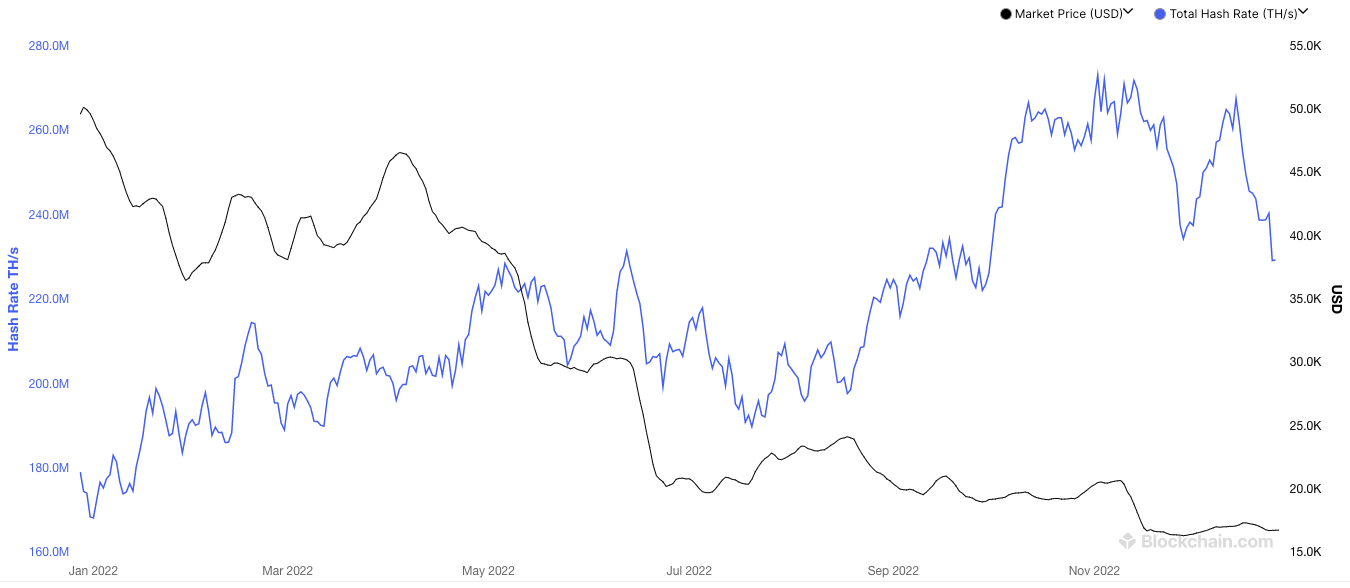

However, a much more remarkable story than Bitcoin’s volatility is the divergence between its price and its hash rate.

Despite losing three-quarters of its value in a year, Bitcoin’s hash rate reached its all-time high of 271.8 EH/s. This divergence between the hash rate and the price is a unique occurrence that hasn’t happened in any of the previous bear markets.

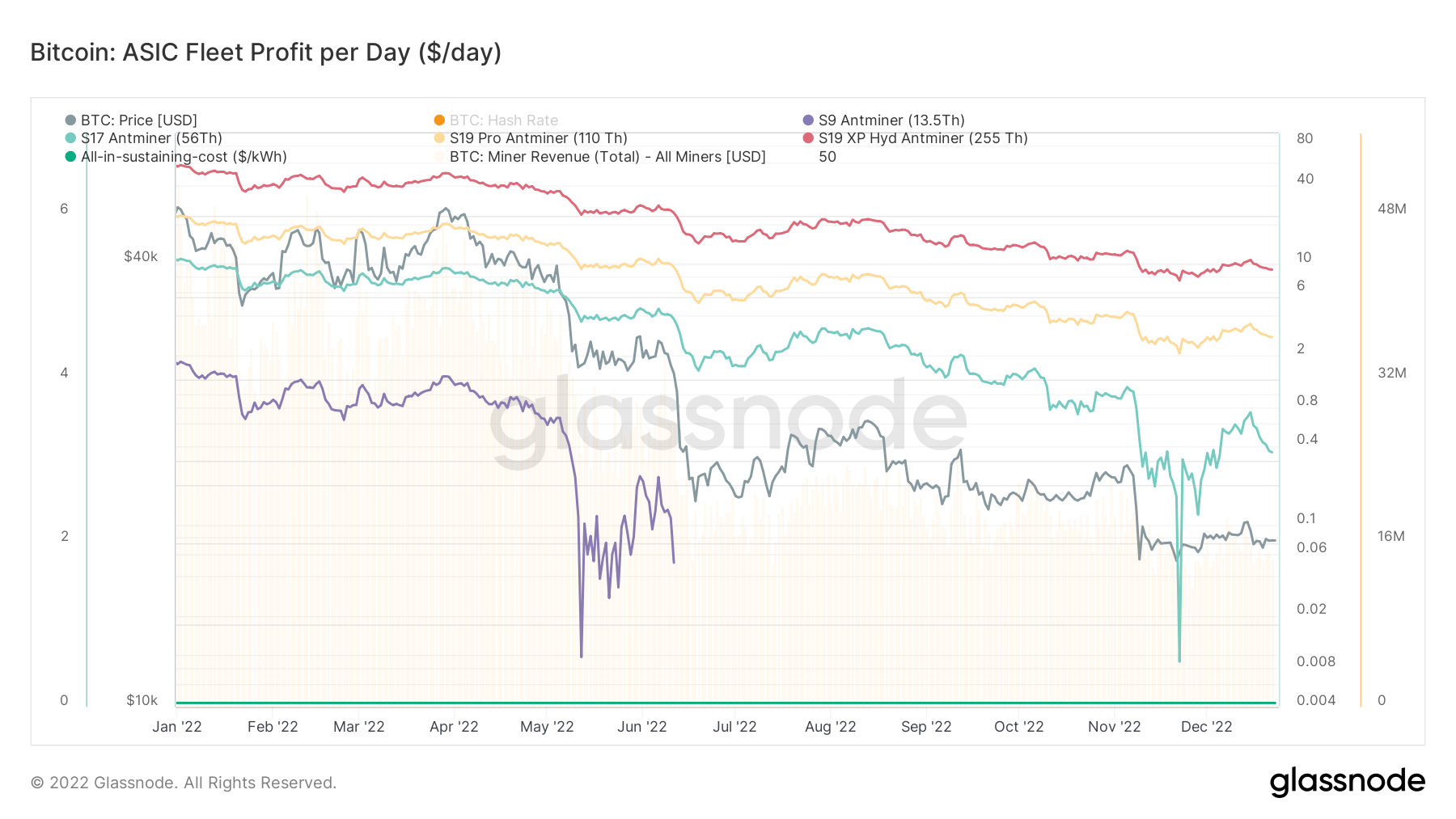

The skyrocketing hash rate becomes an even bigger outlier when comparing it to miner revenues. CryptoSlate previously analyzed miner revenue and found that profits continue to decrease even for the largest and most efficient mining operations.

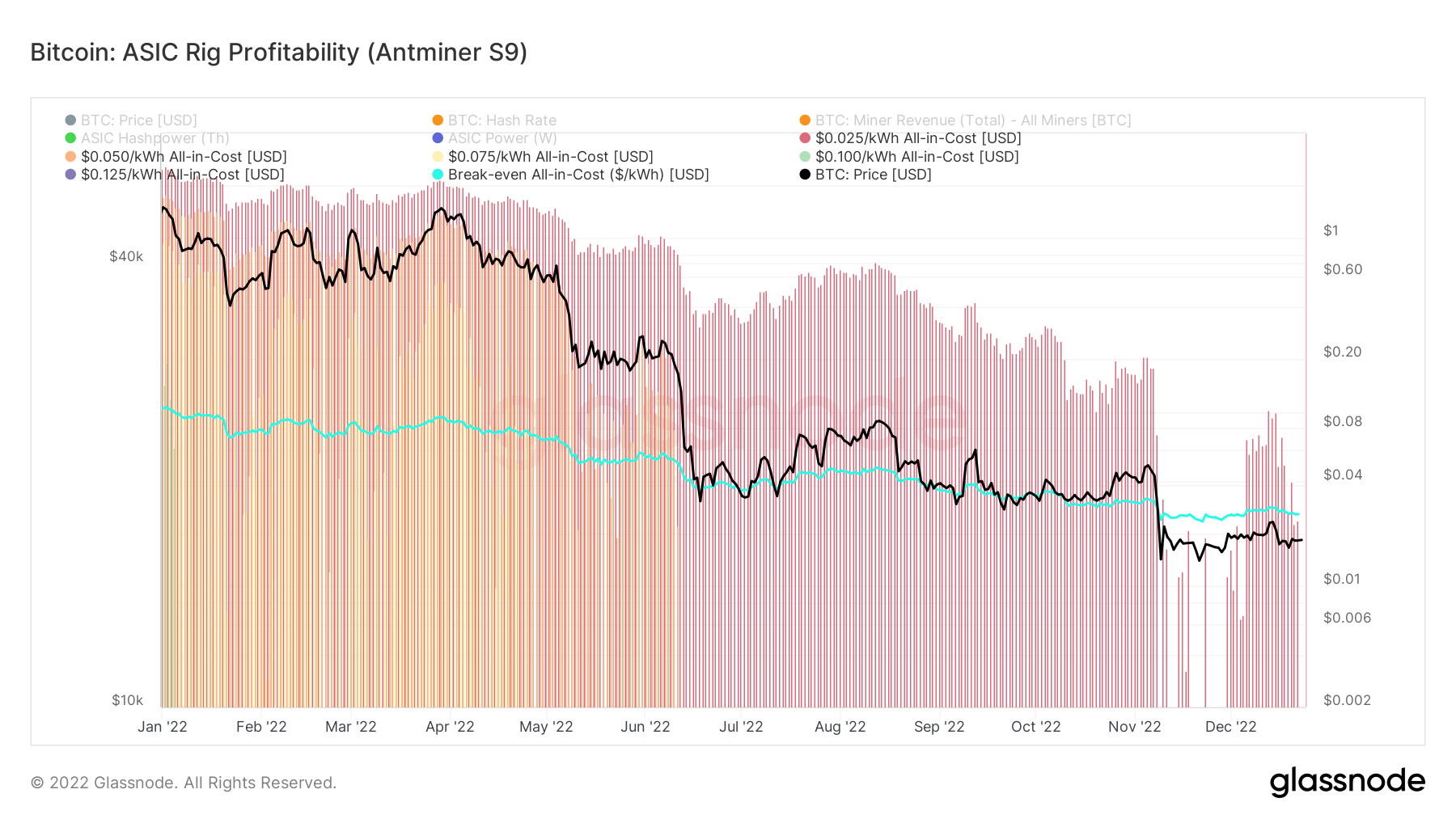

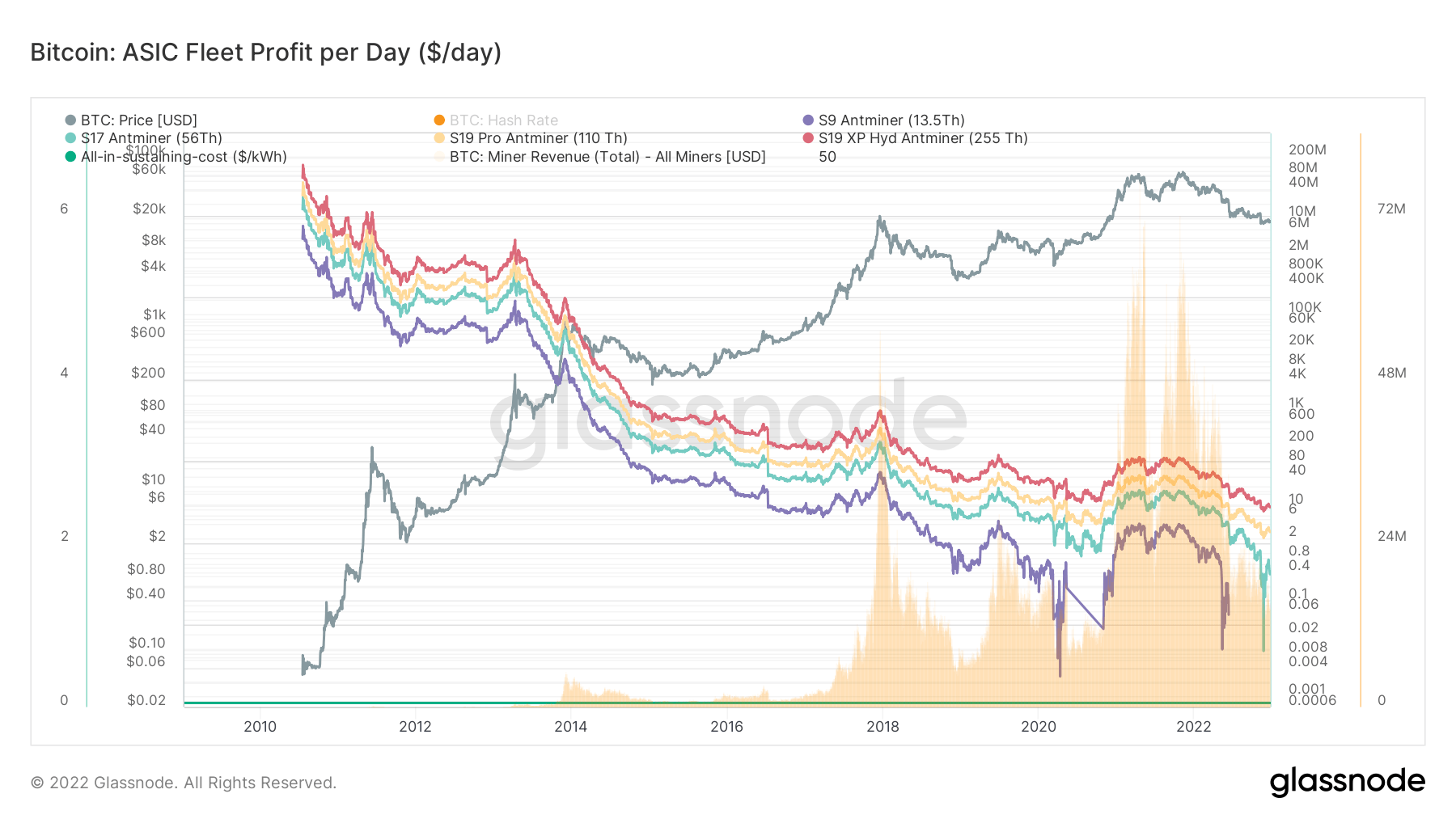

CryptoSlate’s analysis of two popular Bitmain miners paints a bleak picture of the mining industry. Looking at the Antminer S9 and Antminer S17 shows that machines are struggling with profitability.

Launched in 2017, the Antminer S9 remained profitable throughout years of market volatility. However, as the global hash rate began to expand in 2020, the S9 saw its profitability fall until it finally became unprofitable in May 2022, when almost all machines were removed from the network.

With an all-in-sustaining cost of around $0.05/kWh, Bitcoin’s price would need to surpass $19,000 for the Antminer S9 to become profitable again.

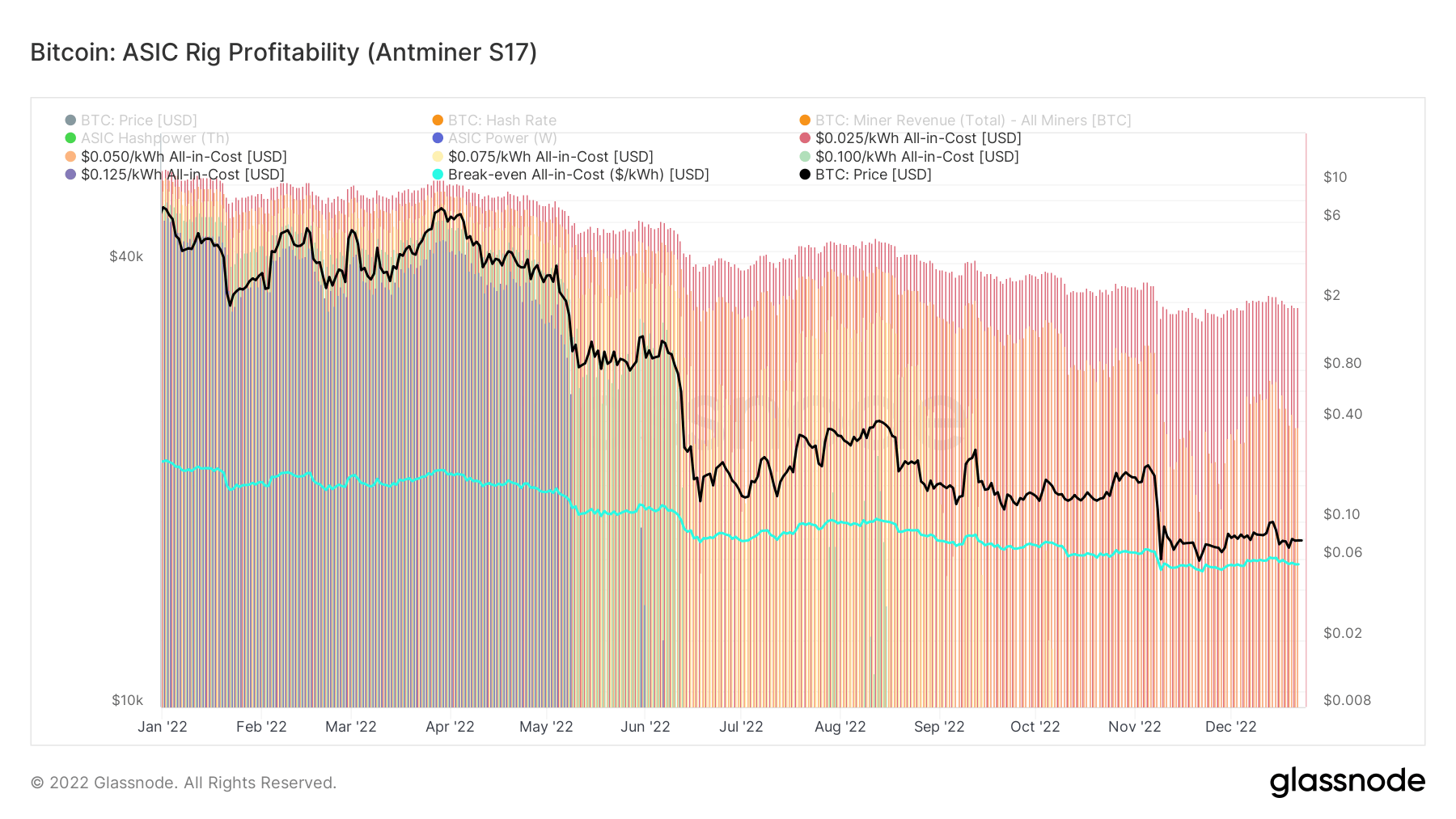

The Antminer S17 is still profitable. Launched in 2019 as a more powerful iteration of the S9, the S17 produced a maximum hash rate of 56 TH/s. Bitcoin’s current price and growing hash rate put the profitability of the S17 at just $36 per day. This slim profit has been decreasing almost daily and is expected to drop even further in the coming weeks.

The S17 has been struggling with profitability throughout the year. The Terra collapse in June 2022 made the S17 unprofitable for the first time ever, as Bitcoin dropped well below $16,000 wiping out billions from the market.

The ongoing market volatility, combined with the ever-expanding hash rate, is currently putting the profitability of the S17 into question. Looking at the profitability chart for the S17 shows that the machine is experiencing a trend similar to the S9.

Barely breaking even, the S17 would become unprofitable if Bitcoin were to fall under $15,500. Crossing the $15,500 could push miners to unplug thousands of S17s.