The Synthetix protocol, which was launched in September 2017, allows users to mint and trade derivative tokens called Synths. Recent integrations and upcoming releases have significantly strengthened Synthetix protocol’s position:

- Recent integration with 1inch is driving up the utilization of the protocol on ETH mainnet

- Several protocols integrated with Synthetix on Optimism, a L2 solution fit for high volume/speed trading, generating fees to the protocol

- These integrations lead to a rise in the fees paid to the protocol. SNX holders, when staking it at the protocol’s pool, are entitled to receive a part of it.

- The roadmap for the next six months has major releases that likely will increase the utilization further

- An increase in protocol revenue, generating an increase in the SNX staking, will remove SNX from the market, likely creating a buy pressure

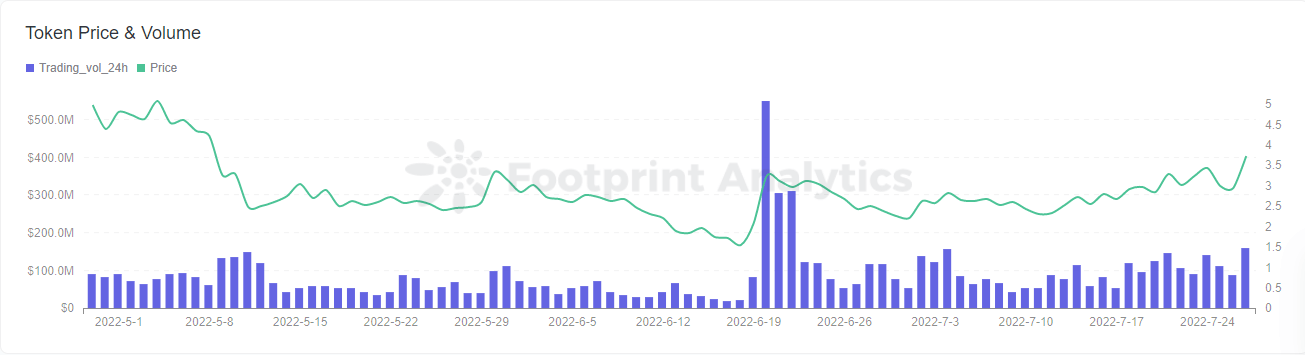

This price rise is supported by several events happening in the last months. Namely:

- Recent releases

- Optimism utilization

- SNX incentives (staking and fees rewards)

- Protocol roadmap

Here is what these mean for the protocol and for crypto derivatives.

What is Synthetix?

Synthetix is a protocol that uses their token, SNX, as collateral to mint synthetic tokens, providing a liquidity solution for almost any asset, virtual or not. For example, it is possible to mint a stock from the US Market, like Tesla, and have a synthetic representation of it on the blockchain. This unlocks the possibility of trading it on decentralized exchanges and derivative markets inside the crypto space.

All SNX used to mint the different types of sTKNs are pooled in one pool. Each sTKN (synthetic token) minted represents a debt (or loan) taken from this liquidity pool. Thus, having a larger pool providing liquidity helps to diminish the pressure on the sTKN peg (the price equivalency it has to maintain with the asset it represents).

The protocol’s main innovation is to allow the user to exchange one Synth for another in a simple way, just like a common swap between two regular assets. Different protocols now leverage this feature, using Synthetix as their base trading/swap layer.

Recent releases for Synthetix

1inch Integration

These last two months were packed with releases and integrations for SNX, the most relevant of which was the integration with DEX aggregator 1inch.

Usually, a DEX has one pool for each trading pair it provides. One pool for ETH<>DAI, and another pool for ETH<>USDC. The ratio between the two assets dictates the asset exchange rate between the pair. The more one pool has of one asset, the more expensive it will be for a user to get the other one (that is called slippage).

1inch is a search engine that tries to find the best possible price for a swap (a trade between two different assets). It does that by quoting the different DEXs. One thing that impacts the exchange rate for this swap is the size of the trade. The bigger the size, the higher the probability that the exchange quoted doesn’t have enough liquidity in the pool for that trade (the price slippage).

The addition of Synthetix means that 1inch now can find a route where users can now exchange large values of ETH or BTC without suffering the slippage of standard DEXs, enabled by Synthetix’s unique ability to swap one synthetic asset for another by simply exchanging the debt (for example, burning sUSD to mint sETH).

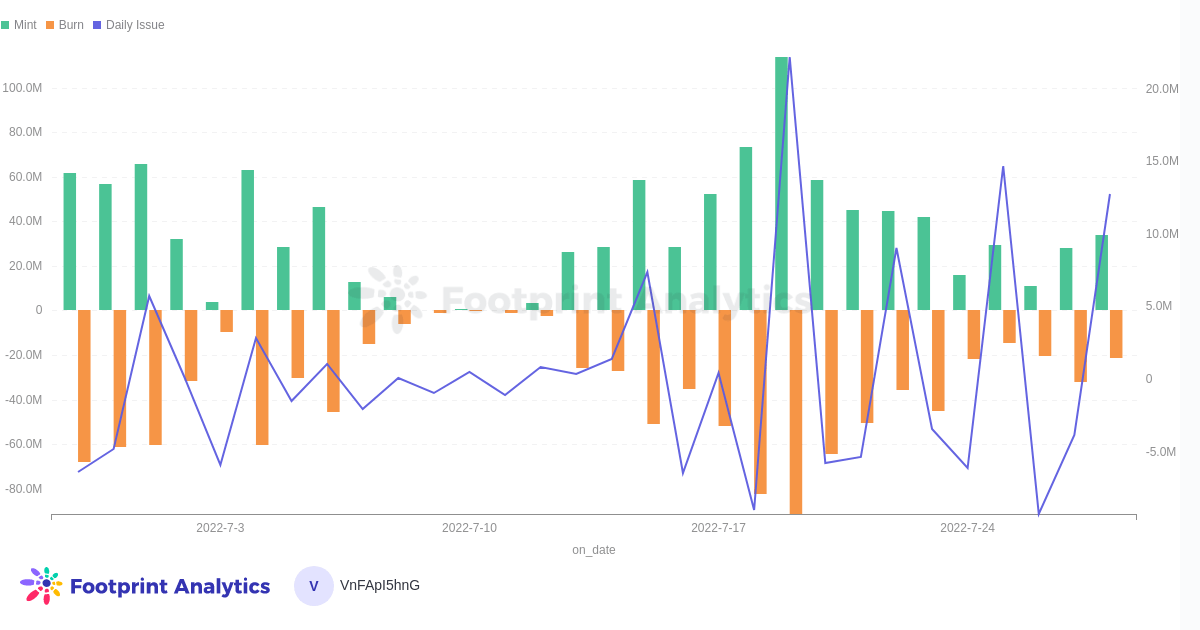

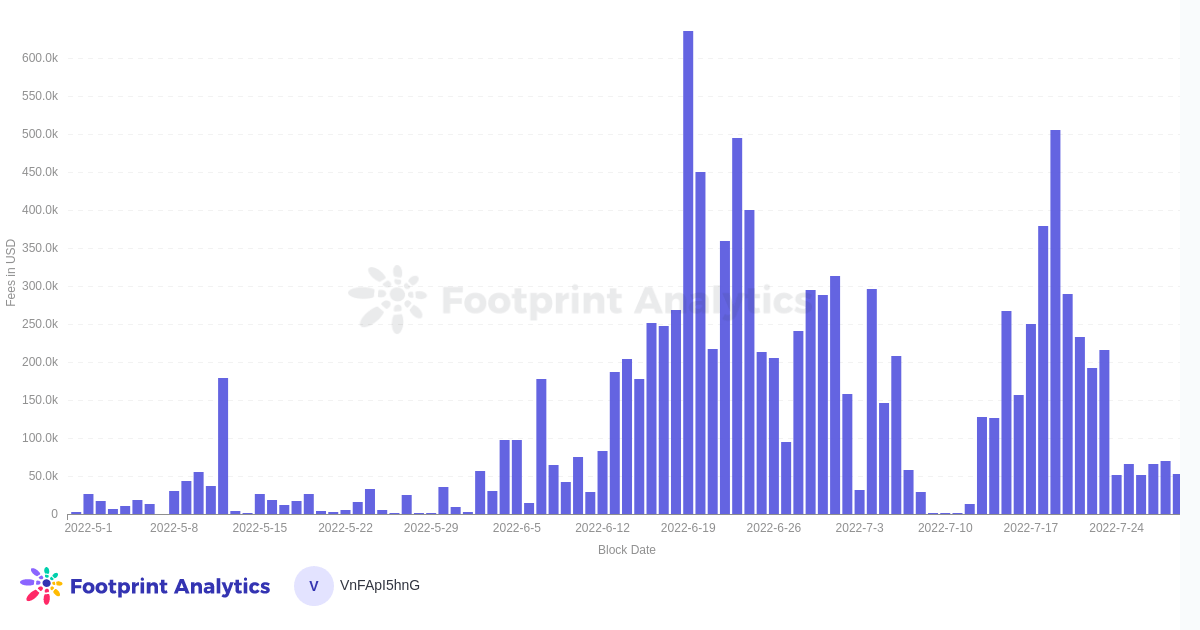

The chart above shows a sharp increase in the usage (mint & burn) of sUSD in the past 2 months, reflecting the integration with 1inch. Integrations with Paraswap and Ox (other aggregators) are also in the Roadmap.

Optimism utilization

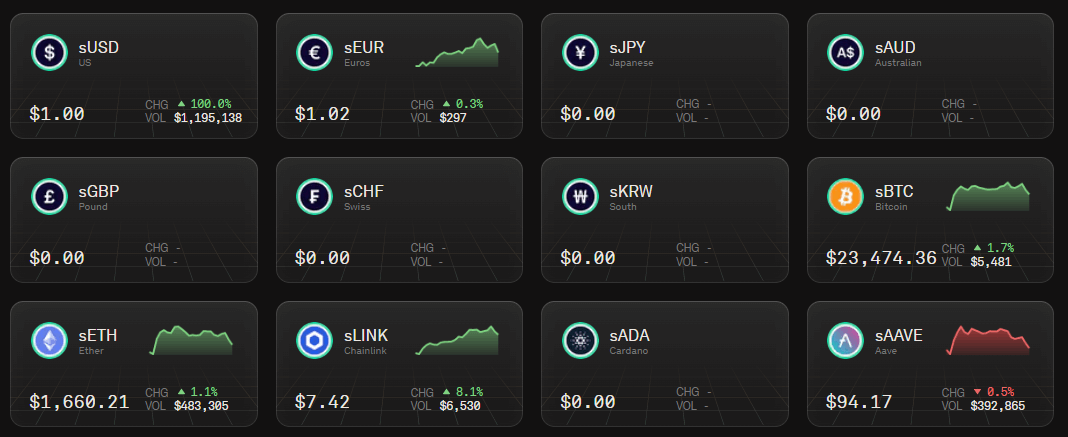

Synthetix was one of the first protocols to announce that it would use the Optimism L2 as a solution to increase its use cases. The list of protocols that now use its Synths on Optimism is large, with a special mention to Kwenta, which acts like a Spot & Derivatives Exchange.

Synths selection on Kwenta – Source: Kwenta website

The popularity of the solutions using Synthetix tokens on Optimism (Kwenta, Lyra, Uniswap) is increasing this year, driving more revenue to the protocol.

SNX Incentives

The SNX token primary function is to act as collateral in the Debt Pool that enables the minting of the synthetic assets. By staking the SNX on the protocol, the holder will receive their share of the revenues collected by the protocol: sUSD fees generated from traders (Kwenta Futures, Lyra options, Kwenta Spot, Curve cross-asset swaps, etc) and SNX inflationary rewards (incentives for staking). The image below shows the current yield of the tokens on staking at Synthetix.

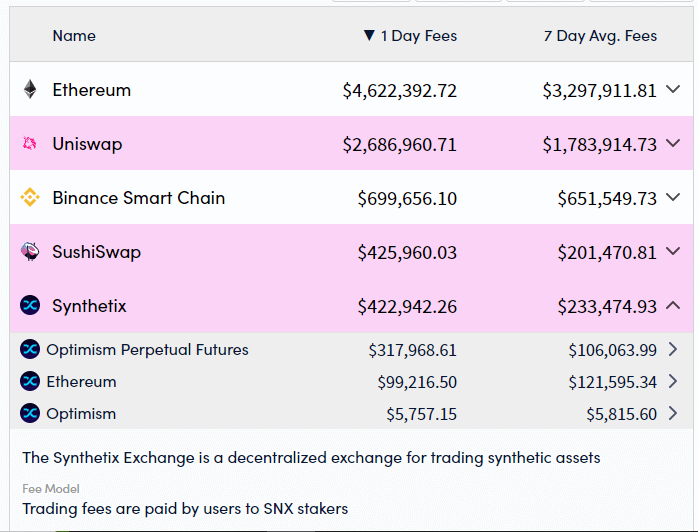

The chart above can verify the increase of fees collected on ETH Mainnet by the protocol, a direct consequence of the integration with 1inch. The table below shows all fees collected by the protocol, and we can see, checking the “Optimism Perpetual Futures” and “Optimism” rows, that a lot comes from derivative trading happening on Kwenta and other protocols at Optimism.

Protocol Roadmap

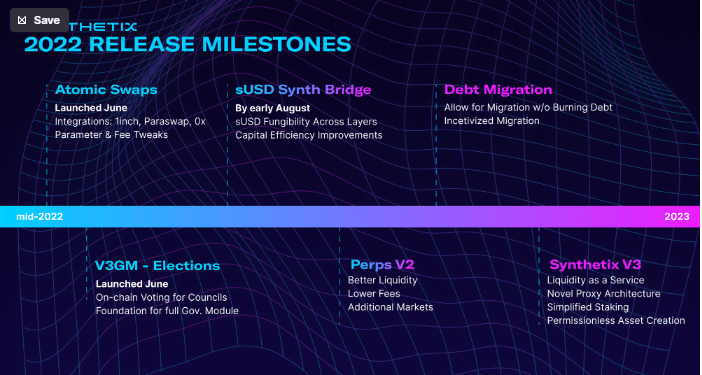

The roadmap for the next months has major releases that will help to make the experience for the users/applications interacting with the protocol more seamless. It is worth noting that the Synth Bridge for Optimism will enable the transfer of assets between ETH and the L2 Optimism, reducing the waiting time for bridging Synths, increasing their volume on that chain, and bringing more liquidity to the Perpetual and Spot trading markets run by Kwenta, for instance.

Version 3 of the protocol will bring several additions that will increase its use cases while incorporating extra incentives for staking SNX into the protocol. One of them is the vote locking tokenomics: a monetary incentive for the users that lock their SNX into the protocol for a period of time (up to four years). They will receive in exchange a vlSNX (vote locking SNX) that will entitle them to higher rewards and voting powers on future protocol proposals.

The Footprint Analytics community contributes to this piece.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.