It has been confirmed that the Ethereum Consensus Layer will be launched as soon as August 2022.

After years of delays, “the Merge” is finally here. However, there is some concern over what will happen to the price of Ethereum (ETH) once proof-of-work is turned off.

Currently, over 13 million ETH is staked in ETH 2.0, and there are concerns that this $26 billion worth of ETH will flood the market following the Merge as investors unstake and sell the news.

Self-proclaimed DeFi educator and member of DeFi Omega Korpi broke down the potential impact of The Merge and the resulting unlocking of millions of ETH.

Staked ETH won’t be unlocked immediately

Korpi pointed out that “the Merge won’t enable withdrawals,” as that is “planned for another Ethereum upgrade” slated to occur after roughly six months to one year. Korpi explained further that:

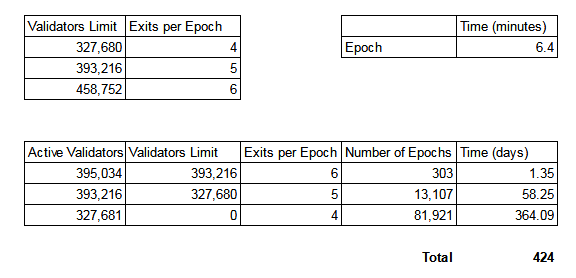

“To withdraw $ETH, a validator must exit the active validator set but there is a limit to how many validators can exit per epoch.

There are currently 395k validators (active + pending). If no new ones are set up (highly unlikely), it will take 424 days for all of them to exit.”

Unlocked ETH will be released slowly

Korpi elaborated that even with withdrawals enabled:

“there will be an exit queue which may take more than a year in the worst-case scenario or several months in a more realistic one. The release will be slow.”

Korpi’s final point regarding The Merge is that most users who have staked ETH with validators are most likely ETH-maximalists and are not interested in selling at current prices.

Liquid staking

Further, there are already ways for ETH stakers to access liquidity from their staked tokens. For investors who are not running their validator nodes, it is common to receive tokens such as bETH in return for staking ETH with a validator.

These bETH tokens are tradeable on the open market, thus releasing liquidity. Therefore, those investors who are not already a part of the validator infrastructure do not need The Merge to happen to access their liquidity in most cases.

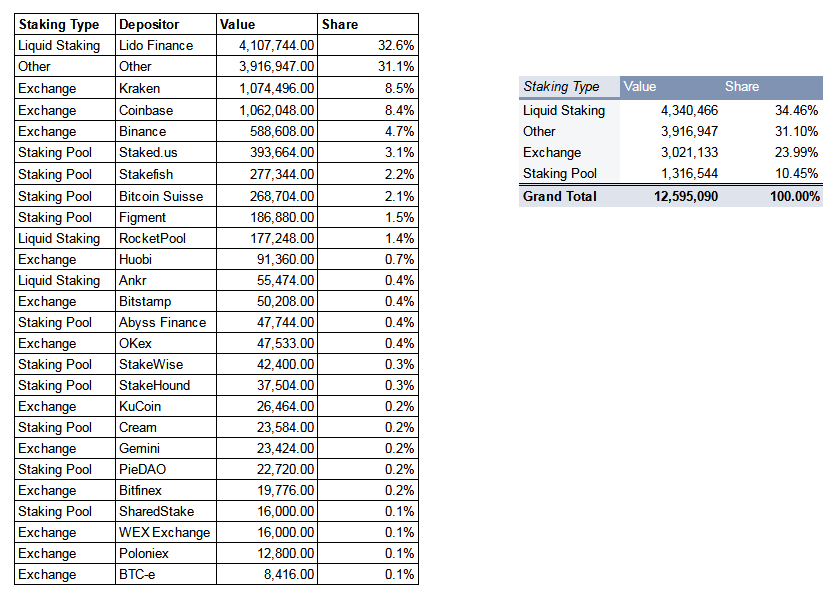

Suppose investors wish to cash out of their staking position; they can sell their bETH tokens. Korpi curated ETH liquidity staking by the platform into the table below, which makes up just 35% of all ETH staked.

In summary, Korpi, who has a backlog of DeFi related information, states,

“I don’t believe we will experience any inflated dumping due to $ETH unlock. It will take place in many months, will be slowly released and many stakers won’t be selling anyhow. My bullish view is intact. ETH will melt faces after the Merge.”

The worry about a vast unlocking of capital after The Merge may be misplaced. Those who want to trade staked ETH can already do so via liquidity products, and those who are running their validators are unlikely to sell on launch.

An investor who has set up a node and has 32 ETH staked over the past few years is invested in Ethereum’s future. It hardly makes sense to stake ETH and then sell and decommission a validator node as soon as it becomes a viable part of the ecosystem. As many in the space have commented,

The Merge may well not be priced in due to skepticism. Often the rule is, “buy the rumor, sell the news.” However, in this case, investors who are not staking their ETH already could potentially be waiting for confirmation that The Merge will be successful.