The crypto market saw a rare comeback on Monday, May 30, after nine straight red weeks for Bitcoin. Juan Pellicer, Research Analyst at Into The Block, believes the rally can be traced to the current recovery in the stock market,

“I think the recent BTC price action is very influenced by the US markets bounce. SP so far is bouncing almost 10% from the lows of last week, so there might be part of the market believing that after the last sharp correction we are in for a fast recovery.”

The correlation between Bitcoin and the stock market had decoupled last week as the S&P recorded gains of 6.94% while Bitcoin closed the week down 8.9%. Unlike traditional markets, the crypto industry never sleeps, and Bitcoin climbed 3% over the weekend. However, as markets opened Monday morning, it was not just Bitcoin that began to rally along with a further recovery in stocks.

Bitcoin has been trading in correlation with big tech stocks for some time as global markets softened. Pellicer is bullish that at least some parts of the market are ready for a “V-shaped” recovery. With Bitcoin down over 50% from its high and many altcoins down over 70%, crypto bulls would welcome this.

Global investment sentiment

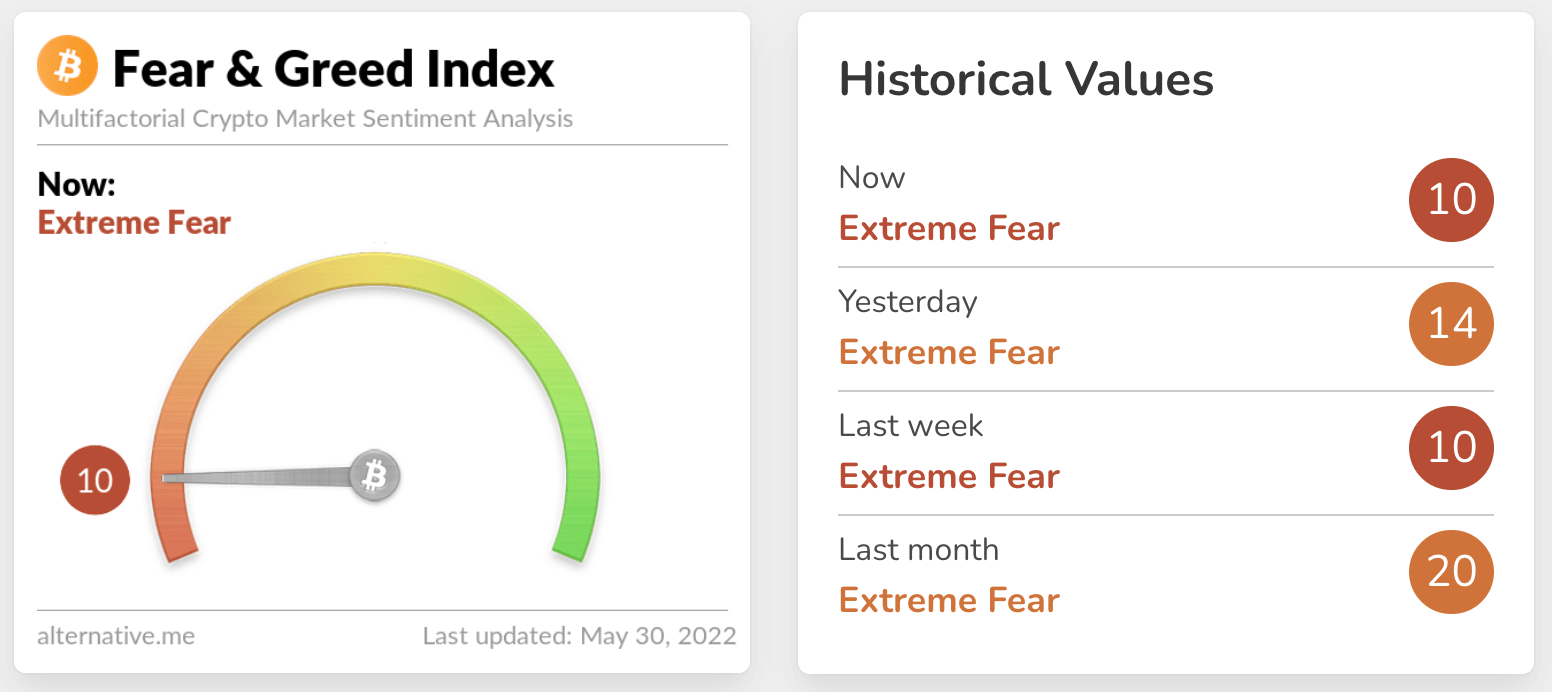

Cryptocurrencies have traded much more like tech stocks than an independent asset class and inflation hedge. However, incidents such as the Terra collapse and fears over the Ethereum merge and imposing regulation have only added to broader global economic concerns.

The war in Ukraine, rising inflation, looming food shortages, and increasing interest rates have also added a negative sentiment to crypto investing. The fear and greed index presently indicates we are close to peak fear with a score of negative 10.

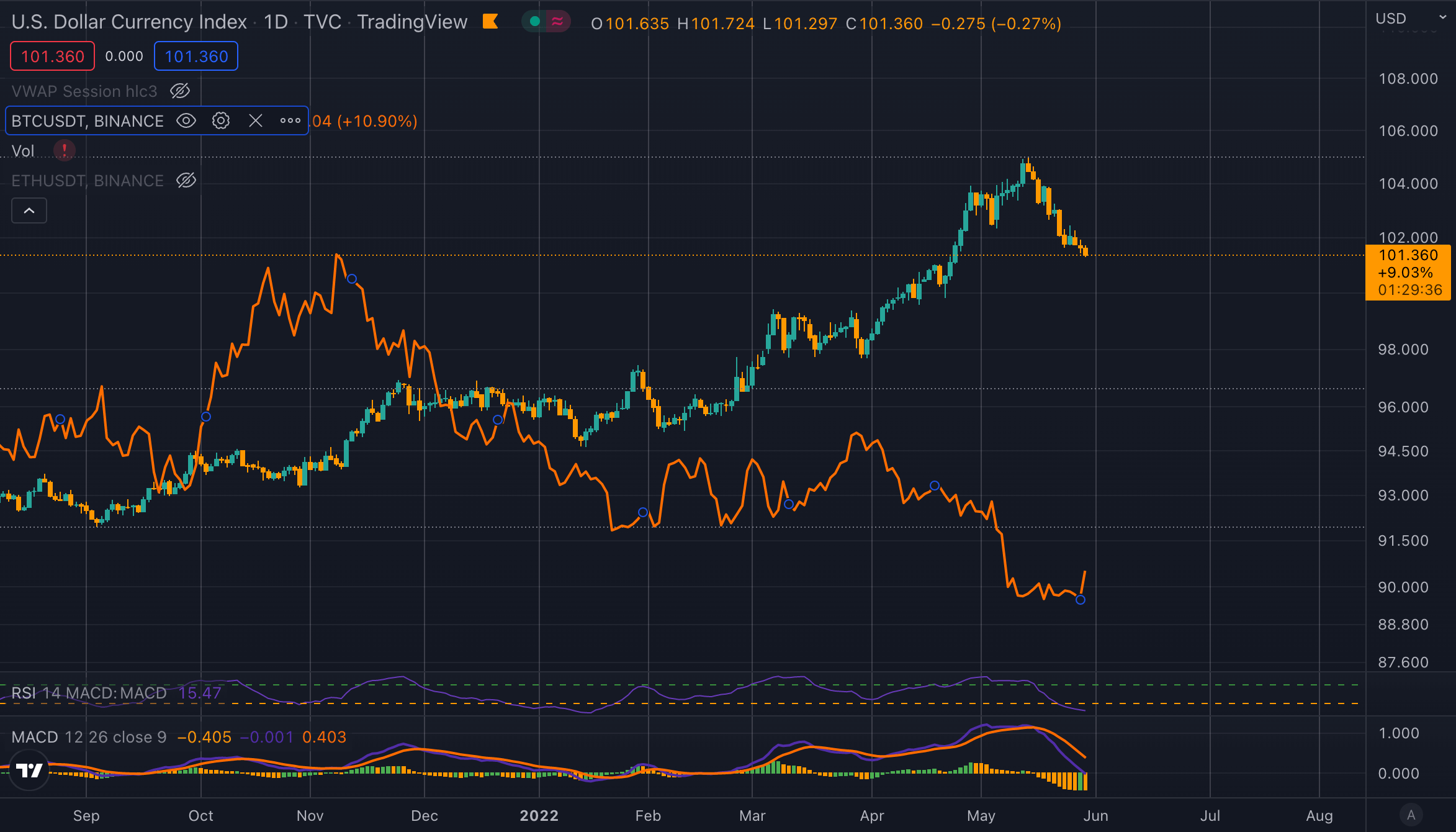

Weakening dollar value

It is worth noting that the dollar’s strength is also a factor in assessing the price of cryptocurrencies. Most cryptocurrencies are valued against the dollar using stablecoins such as USDT, BUSD, and USDC. As the dollar weakens, the value of cryptocurrencies will organically rise.

The chart below shows the divergence of the $DXY and Bitcoin. Since 2021, as the DXY has risen, the price of Bitcoin has demonstrated a negative correlation. Positively for the crypto industry, Bitcoin is also rising against other major currencies, confirming the breakout.