Over the past month, Bitcoin has been trading relatively flat, ranging between $18,400 and $22,800.

Against a deteriorating macroeconomic backdrop and an escalation of events in Eastern Europe, some analysts see this as the start of BTC decoupling from legacy markets.

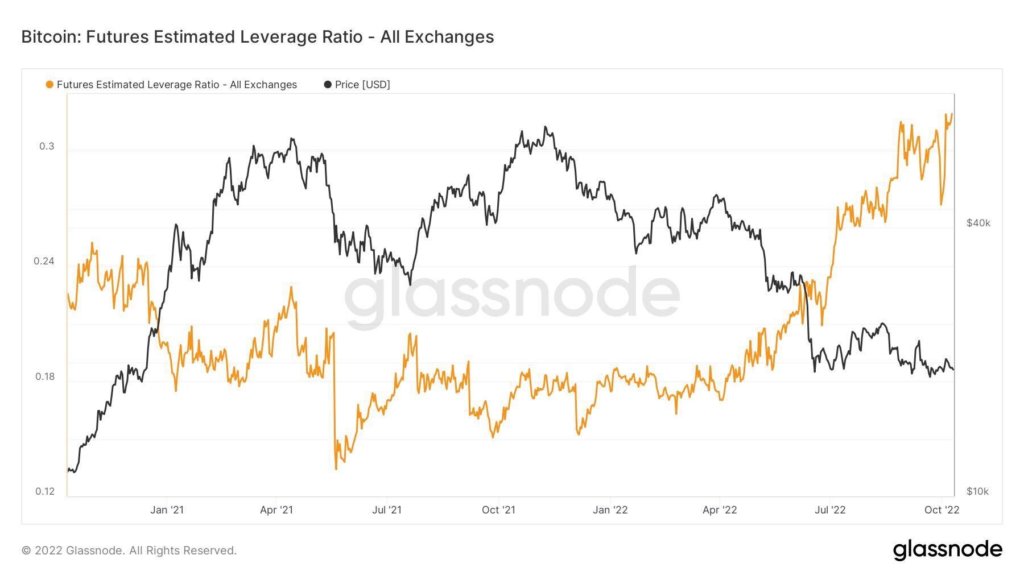

Bitcoin Futures Estimated Leverage Ratio

The Bitcoin Futures Estimated Leverage Ratio (ELR) metric refers to the proportion of open interest divided by the reserves of an exchange. Open interest relates to the number of outstanding (unsettled) derivatives contracts at a given time.

This metric expresses the average leverage currently used by derivative traders in the market. A high ELR often coincides with BTC spot volatility. Under this scenario, derivative traders are at liquidation risk.

The chart below shows ELR at an all-time high of 0.34, suggesting a high liquidation risk. While direction calls can not be made with certainty, the likelihood of a downside move is stronger, given that BTC is trading down on higher macro time frames.

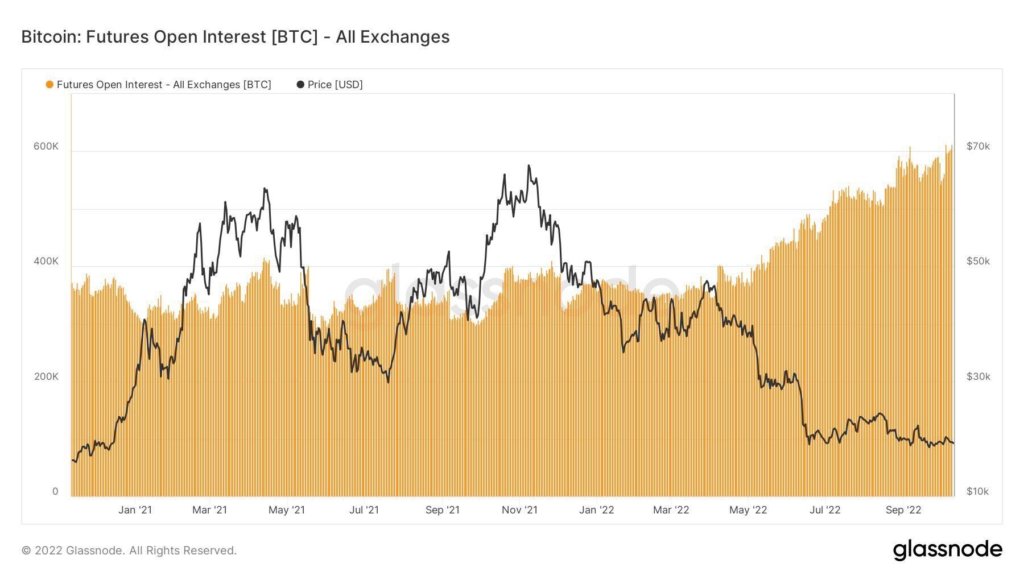

Futures Open Interest

As previously mentioned, Open Interest is a measure of the outstanding futures contracts at a specific period in time. High Open Interest means new traders are opening positions giving a net increase.

The chart below shows Open Interest building from a yearly low in March, climbing progressively highly into the present. With a current reading of approximately 600,000 contracts, it’s clear that derivatives traders are continuing to pile in, despite the deteriorating macro environment.

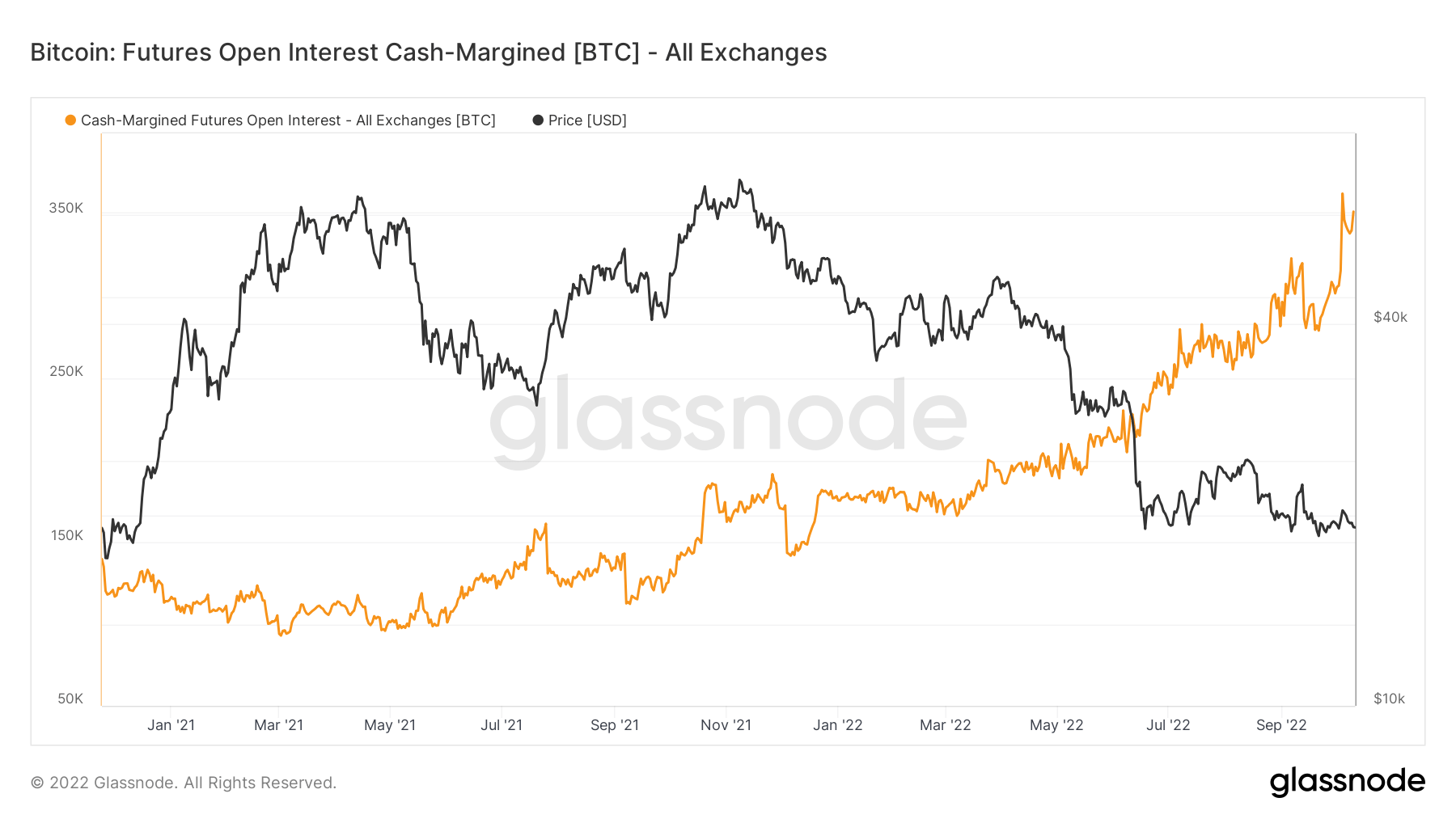

Similarly, Open Interest Cash-Margined (OICM) also represents interest but from a money flow perspective. As expected, with Open Interest spiking higher since the March lull, money flowing into Bitcoin Futures has also trended upwards.

Except for a dip in mid-September, the OICM has resumed its uptrend to peak at approximately 360,000.

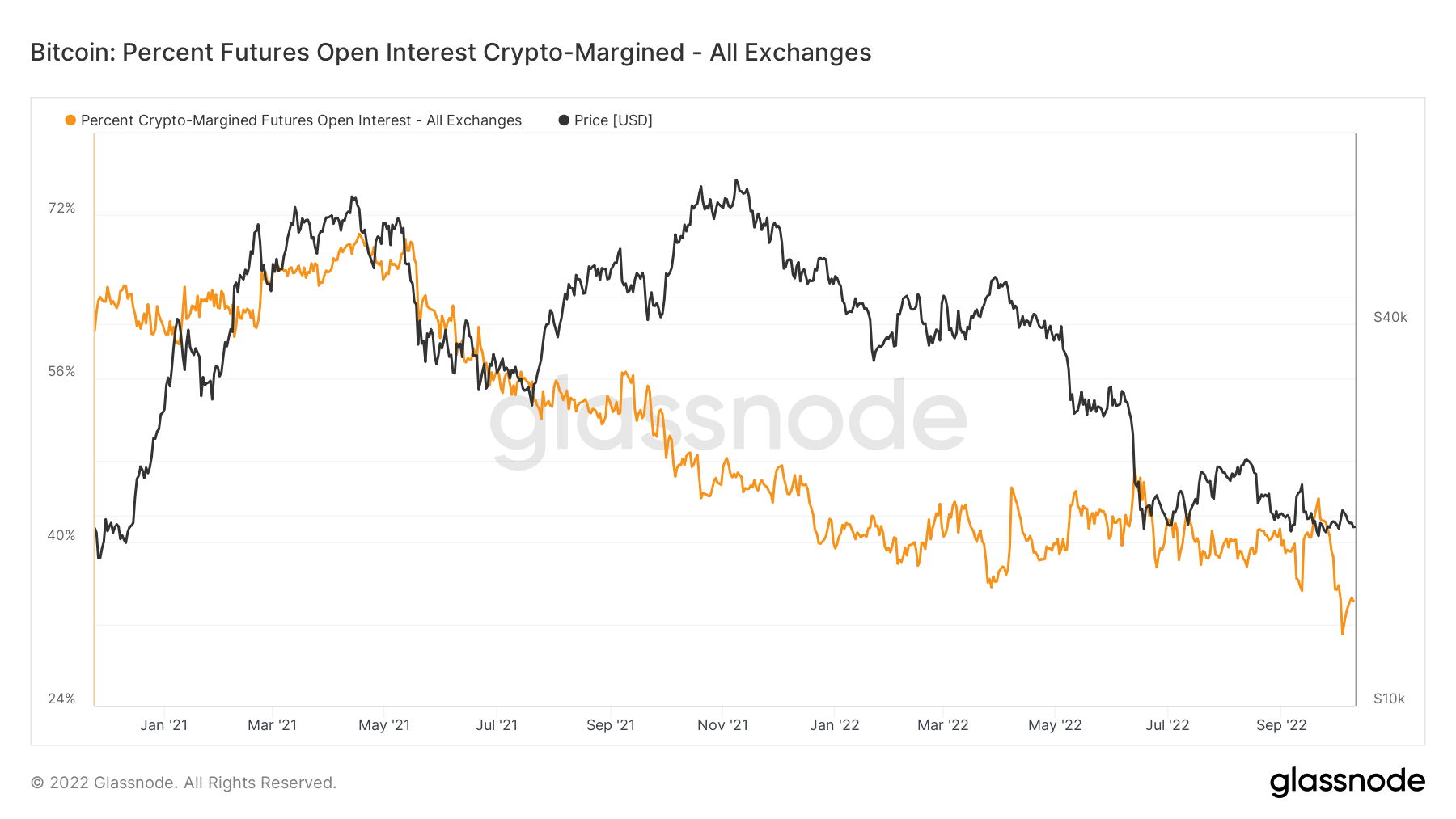

During the 2021 bull run, traders were majority using Bitcoin to open futures contracts, presenting a significant but acceptable risk during euphoric times.

Now, in the bear market, traders have switched to cash, resulting in a drop in the Open Interest Crypto-Margined metric from a peak of 70% in April 2021 to 38% at present.

Futures Perpetual Funding Rates

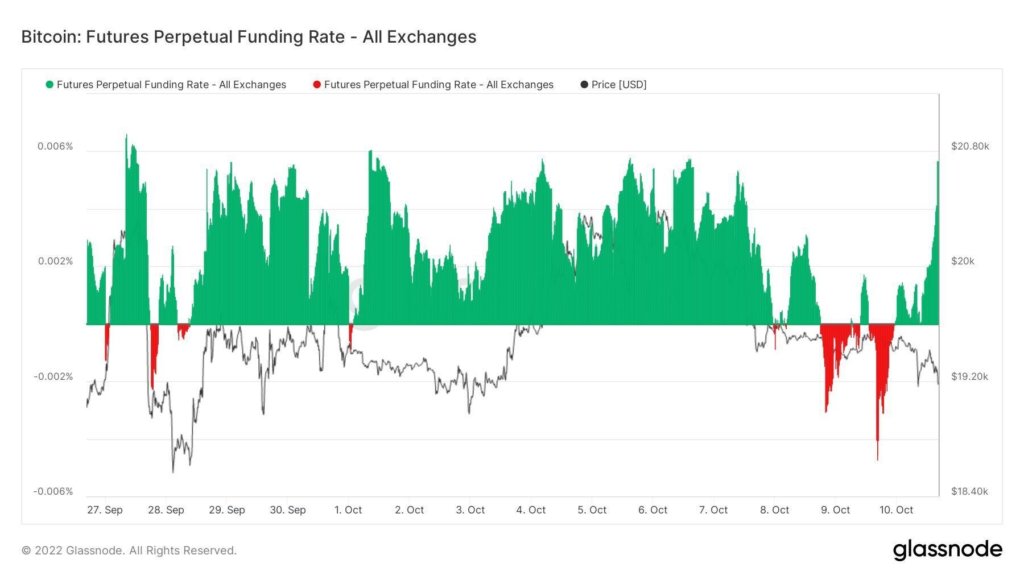

The Futures Perpetual Funding Rate (FPFR) refers to periodic payments made to or by derivatives traders, both long and short, based on the difference between perpetual contract markets and the spot price.

During periods when the funding rate is positive, the price of the perpetual contract is higher than the marked price. Therefore, long traders pay for short positions. In contrast, a negative funding rate shows perpetual contracts are priced below the marked price, and short traders pay for longs.

The mechanism was designed to keep futures contract prices in line with the spot price. The FPFR can be used to gauge traders’ sentiment in that a willingness to pay a positive rate suggests bullish conviction and vice versa.

Since May, the funding rate has been broadly neutral. But from late September onwards, the chart below shows that the funding rate has been majority positive, with recent days seeing a flip between negative and positive funding.

Over the weekend ending October 9, a sharp dip in the finding rate to -0.005% was proceeded by a strong move in the opposite direction, hitting +0.0058%

The Estimated Leverage Ratio and Open Interest are at all-time highs, and with positive funding rates prevailing, the crypto market is significantly hot and overleveraged to the upside.

Widespread liquidations may occur in the near term, triggering a decline in asset prices led by Bitcoin.